Azuro - Prediction Market Infrastructure: What You Need to Know

$AZUR TGE, Prediction Market Ecosystem, & More

The last rally that BTC saw was in part due to changing political tides, in addition to ETF rumors. Compared to crypto cycles past, this current cycle definitely stands out as one that has had a significant impact on the presidential elections. Previously, crypto was sort of a market all alone, with little impact outside of its own bubble. Now, with industry innovation has come new tools for gauging political sentiment, as we’ve seen the rise of prediction markets, namely Polymarket. While US elections easily take the cake when it comes to the most popular markets, other nations including European and LATAM elections have also seen some action. On the sports side, the Euros is now taking place, with the NBA season having recently completed and the draft underway, creating new opportunities to bet on. Of course, prediction markets aren’t only for betting; they can be used strategically to hedge against other positions, and perhaps more importantly, to get a read on odds and likelihoods of certain events. Polymarket has been pointed to and quoted as a means of sharing the latest election odds, much like Las Vegas betting odds which are used to forecast sporting events outcomes. Crypto prediction markets are in a unique spot as they allow for almost anything to be bet on, big or small, while in traditional markets, certain bets would simply never have a significant market made and it would be difficult to find any formal way to bet on things that are out of the normal scope. In crypto, the main problem lies in verifying the actual information that dictates the market’s outcome and resolving disputes around this information, with some high-profile cases of platforms having to make judgment calls already having taken place.

Prediction markets are incentivized to be accurate: people who make better predictions make more money, and they are motivated to gather and process information as efficiently as possible. Unlike participants in a survey who have no motivation to provide accurate answers, participants in prediction markets have a financial stake in their predictions. This financial incentive also acts as a motivation for markets to remain as up-to-date as possible, taking into account the most recent news, or otherwise risk losing capital. Prediction markets also may incorporate more diverse POVs as opposed to traditional polls, which sometimes target specific groups of people or are structured in a way to encourage certain results. It is possible that the nature of unchain prediction markets creates a self-selection bias, a separate problem from what exists in other means of surveying. One aspect of public surveys that often isn’t taken into account is how expensive they are, a cost which is incurred with each new set of polls; meanwhile with prediction markets, participants provide the funding with the aim of turning their money into more money. So far we’ve seen prediction markets hit the mark when it comes to forecasting accuracy, for the most part. Even pre-market trading of tokens on platforms like Aevo has proven to mostly be congruent with actual values found after TGE.

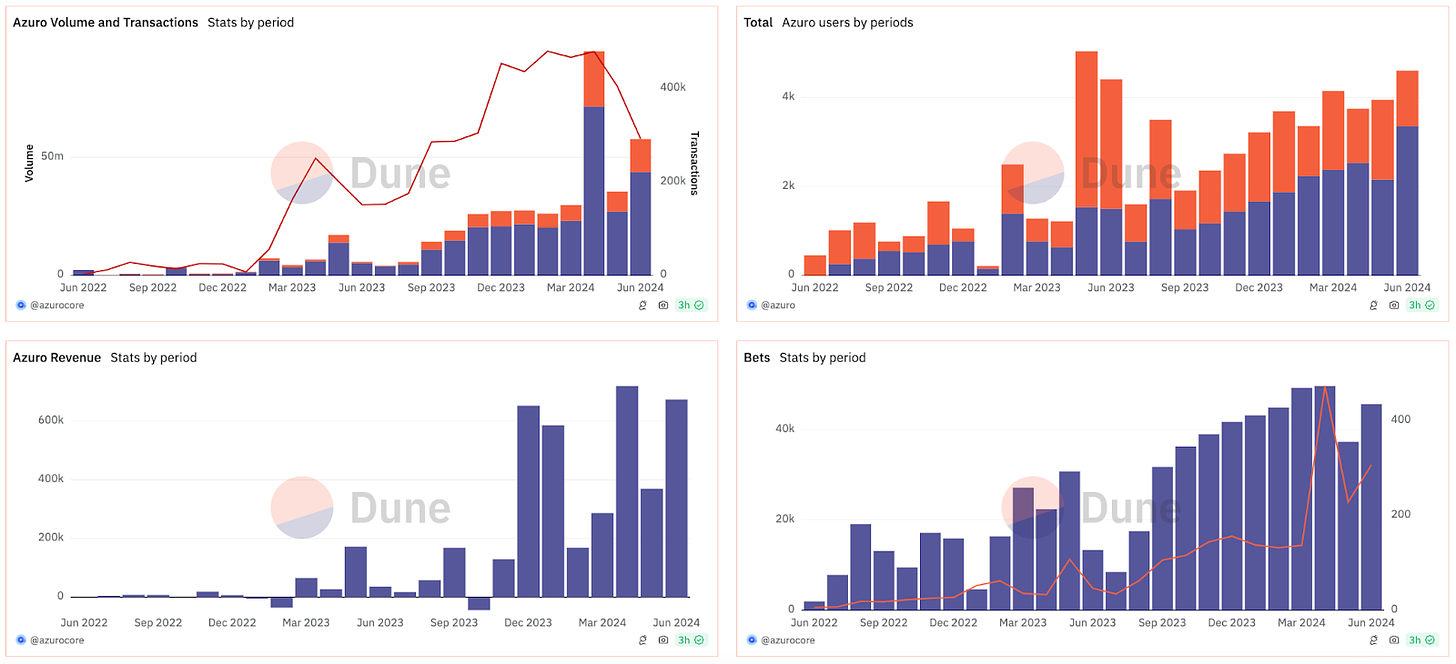

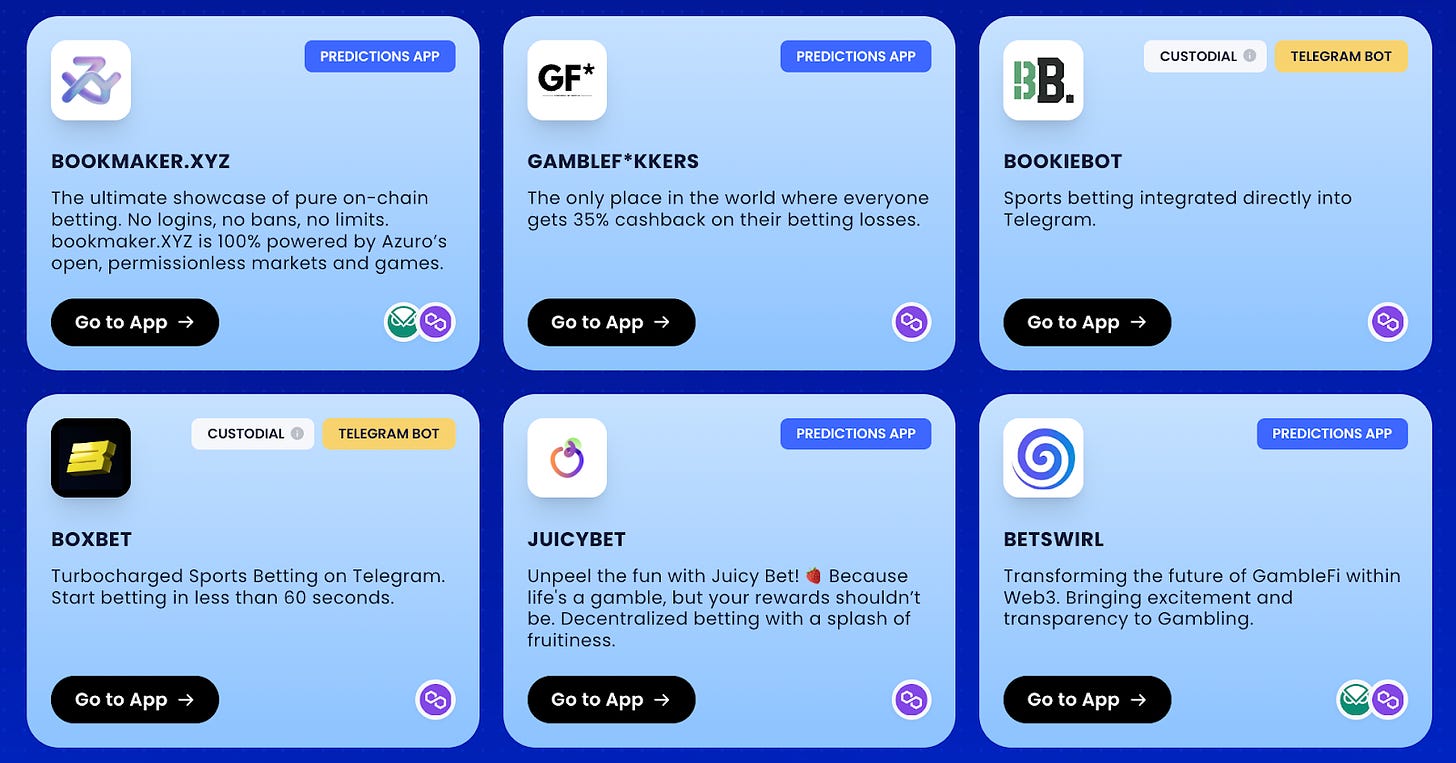

In today’s edition, we’ll be discussing a bit about Azuro. Azuro is an infrastructure & liquidity layer for predictions and games, a part of a new generation of prediction markets that have evolved beyond the original concepts that have existed since 2014. Azuro isn’t a specific platform for taking bets, but rather a “tooling, oracle, and liquidity solution” for other protocols to build prediction markets on top of. The team provides a middleware protocol that connects to any EVM chain, facilitating the integration of their Oracle liquidity solution and market settlement. This setup allows builders to easily create applications focusing on user acquisition and experience without needing extensive coding skills. Azuro’s adoption has grown significantly in a span of less than two years, with over $8.2M in TVL, and $420M cumulative volume traded, not to mention the protocol’s recent AZUR TGE which took place last week.

Catch our third episode of DeFi Revelations ft. Pryzm; the Layer-1 appchain dedicated to transforming yield management!'

Background on Azuro

When it comes to prediction markets, early tech limitations, and poor user experiences hindered the growth of prediction markets, which were originally envisioned as peer-to-peer platforms according to the Ethereum whitepaper. Of course, Vitalik would continue to voice support for prediction markets as a key use case for crypto. Peer-to-peer prediction markets struggle with efficiency, particularly for markets with significant volume like sports or financial markets. These markets have an inherent dependency on active liquidity and the necessity for market-making to ensure user engagement. Even successful platforms like Polymarket face challenges with limited liquid markets, with significant activity concentrated on major events like the US presidential election. Highly anticipated markets built around elections are also subject to some issues that don’t really exist in more year-round markets like sports, which Azuro initially focused on. These markets have been well-tested and generally don’t present major dispute challenges. This may be in part due to the wide variety of stats available; users know what stats and outcomes will be clarified at the end of a match. Sports leagues also have consistent seasons every year, providing a stable volume of games and betting opportunities, unlike political events that occur less frequently.

Sports are the primary focus because of their vast betting volume and the necessity of a seamless end-user experience. Focusing on sports makes more sense from a business perspective due to the constant availability of passive liquidity, which is essential when starting or focusing more on these markets. It is also very expensive to incentivize liquidity in markets like presidential elections because they cannot be easily hedged, presenting a challenge for market makers who prefer minimal inventory risk.

Azuro’s approach involves a peer-to-pool model that replicates traditional betting mechanisms but on the blockchain, aiming to provide passive liquidity and manage risks effectively to prevent losses from passive liquidity providers. Adding more markets helps diversify risks and enhances capital efficiency, which tends to increase with scale unlike in other DeFi sectors where it decreases due to stagnant liquidity. With this model, size does not deteriorate returns but rather enhances user experience and supports higher volumes, increasing yield returns into the liquidity pool.

Azuro includes a liquidity solution, an oracle, and tools supporting dispute resolution solutions for application builders. Azuro uses a liquidity pool design called the liquidity tree, made for markets with known resolution times, like sports. This liquidity tree pool system is currently the highest-yielding stablecoin pool on Polygon, with 20% in unsubsidized returns. Another notable feat of Azuro is the fact that the protocol often ranks as the top revenue-generating protocol on Polygon. The current Oracle solution is centralized but the team’s plans to decentralize by the year’s end are currently underway. Dispute resolution is managed by an optimistic oracle approach, which is generally effective, especially in clear-cut cases like sporting events.

$AZUR Tokenomics

Azuro actually had its TGE last week. This was not exactly the best time to launch a new token, as AZUR and other high-profile launches have not performed very well given these current conditions and a renewed weary attitude from market participants toward low cap/FDV ratio tokens. That being said, AZUR is in an interesting spot as the prediction market space doesn’t have many liquid options for exposure, with Polymarket being the dominant player but with no token live.

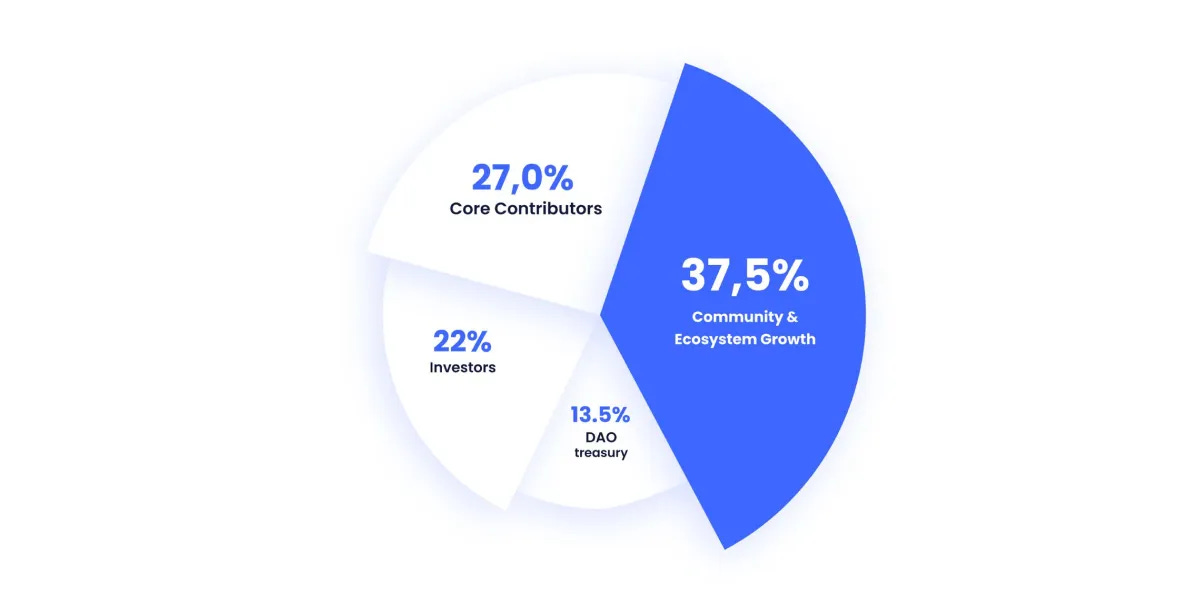

The AZUR launch was highly anticipated, with pre-markets seeing over $1M in points traded on Whales Market, as well as some action on Aevo. Since shortly after TGE, AZUR is down nearly 40%, sitting at ~$0.085, slightly above the TGE price of $0.075. AZUR launched with a ~15% circulating supply (152 million tokens out of 1 Billion). AZUR is also being used to incentivize the AZUR/ETH pool.

When it comes to token utility, AZUR is used for governance, which is mainly used to decide on new proposal outcomes, dictate general risk management frameworks, product prioritization, grants, integrations, incentives, and more. ‘Staking’ is also touted as a utility feature, allowing users to earn rewards via a Zero Emissions Model (ZEM). AAZUR is being used as a reward token in the SuperCombo Game, a jackpot 15-event market. Stablecoin rewards from user activity are what fuels the native staking rewards. Azuro also has a built-in prediction market native feature for its utility token, an AZUR liquidity pool with 0-odds spread (no house edge). This is used to create an interesting token-based prediction market for “price-sensitive users”. The team will also be pushing Ecosystem Rewards V2, which will introduce a tiered AZUR bribing system.

Overall, the betting and gambling industry has fragmented significantly due to the introduction of crypto as a payment method. Along with Polymarket, Azuro has helped to play a role in accelerating this fragmentation by enabling anyone to launch their betting applications easily and affordably.

Of the 30+ apps built on Azuro, some have gone on to generate significant revenue, emphasizing the transformation in accessibility and the potential of betting and prediction markets enabled by their technology. When it comes to a vector as wide as prediction markets, going the infrastructure route instead of providing a direct-to-consumer platform may see slower growth at first, but come out ahead in the long run, removing some of the headache and burden associated with maintaining platforms and markets and leaving this up to ecosystem teams to hash out amongst themselves. Veda, a yield optimization protocol which we discussed earlier this week, has quietly seen massive increases in TVL by going the infrastructure route despite very little effort on marketing. Azuro is distinct in that it is a protocol that other developers and teams can build on top of, and thus benefits from having large network effects, but parallels can be drawn.

Important Links

Become a Premium member to unlock all our research & reports including access to our members-only discord server

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $116.58/month you’ll get:

Premium access to the entire Revelo Intel platform

Members Only Discord server

Market Intel - actionable trade ideas

Industry Intel - important trend & narrative overviews

Project Breakdowns & Timelines - Deep dive 50+ page protocol-specific reports

Notes - Summaries of your favorite podcasts & AMAs