Bumper - AI-powered Volatility Protection: What You Need to Know

Price Prediction, Sentiment Analysis, TA, & More

AI is one of, if not the most powerful narrative in crypto currently; and it’s not going anyway anytime soon. Just yesterday, Apple announced a significant integration with OpenAI to bring generative AI usecases to users’ fingertips. NVDA continues to soar, increasing interest among crypto natives looking to get some more industry-specific exposure. While there’s indeed a lot of demand for crypto-adjacent assets in crypto, there aren’t too many projects actually implementing AI into their operations…

In today’s edition, we’ll be focusing on Bumper. Bumper is taking AI in a new direction with its initial premise, which is protecting against downside. Bumper is a novel DeFi protocol that enhances traditional derivatives markets by providing a simple, fair, and decentralized approach to hedging price risk. The protocol leverages a loss prevention tool that provides price protection against market crashes and downside volatility. Bumper’s philosophy revolves around establishing a fair procedure for the distribution of gains and losses in a risk market. Unlike traditional adversarial markets, where there is typically a winner and a loser, the motivation of Bumper is to create a system that promotes fairness and just distribution of resources. Bumper’s purpose is to provide a mutual price risk facility, prioritizing the minimization of individual losses over maximizing individual profits. By focusing on risk management and protection, Bumper aims to create a more secure and reliable environment for participants in the DeFi ecosystem.

As you know, crypto is inherently volatile; it can be difficult to limit the downside while still retaining the upside effectively. This is the area in which Bumper’s AI integration shines; the team puts AI to use to help predict price movements and in turn provide users with higher yields, lower premiums, boosting efficiency and solvency.

Stay alert, stay informed ⬇

Background on Bumper

Bumper exemplifies a project that credibly aims to integrate AI to improve its existing protocol. As previously anticipated, Bumper’s AI integration strategy revolves around three key AI tech stacks, each designed to address specific challenges and augment the protocol’s capabilities:

Price prediction

Sentiment analysis

Technical analysis

To validate the accuracy and effectiveness of its prediction models, Bumper employs a proprietary Agent-Based Modelling (ABM) approach. ABM is a computational technique that simulates the actions and interactions of autonomous agents (such as individuals, groups, or entities) to evaluate their impact on the overall system. These agents adhere to predefined rules and can learn, adapt, and evolve based on their experiences and interactions.

Agents are important as Bumper operates as a two-sided marketplace of makers and takers: users on one side hedge by locking in a floor price for a set term and pay a premium for that, while users on the other side deposit stablecoin liquidity to earn yield. Pricing the cost of this premium to satisfy both sides of the marketplace needs to be optimized: if it’s too expensive, takers won’t participate; if it’s too cheap, it’s not attractive for makers to deposit and put their capital at risk. The challenge is finding a sweet spot, which becomes more complicated as prices move and volatility changes. This is why Bumper’s ABM tool is so important, as it allows for dynamic adjustments to fairly price premiums according to real-time volatility, ingesting signals from LLMs to pre-empt market trends and rebalance proactively.

Using this ABM approach to support its AI integration strategy, Bumper forecasts an economic improvement of 5-25% in the protocol’s efficiency, effectively balancing the trilemma of Lower Premiums, Higher Yields, and Solvency Robustness.

Price Prediction

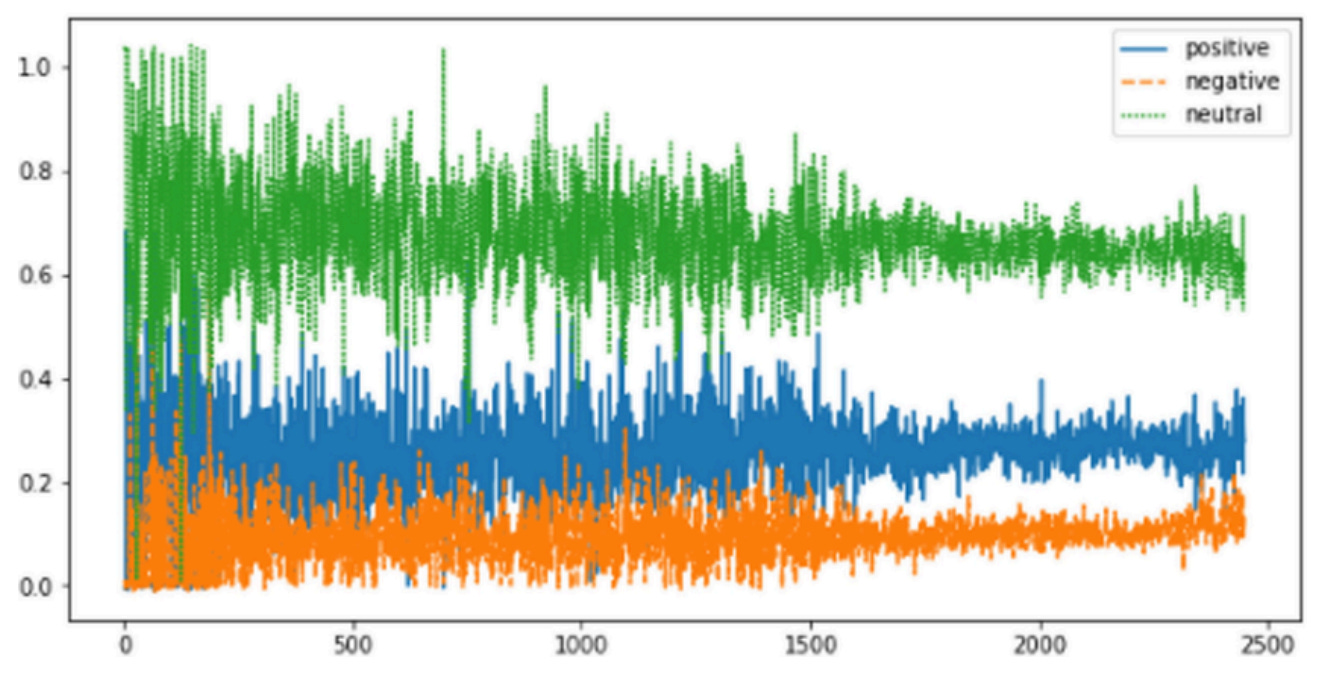

The first AI tech stack is related to Price Prediction, utilizing a 70-billion parameter Large Language Model (LLM). Bumper trained this LLM with financial data, including Price (open, high, low, close) and Volume metrics of Bitcoin price datasets. The LLM is fine-tuned using Reinforcement Learning from Human Feedback (RLHF), rewarding the model for predictions that match normalized actual price data. The figure below provides a visual representation of the Price Prediction for Bitcoin using Bumper’s 70-billion parameter LLM.

Initially trained on daily open/close prices and later on hourly data, the ongoing process aims to eventually incorporate tick data for even greater precision. Given that $BTC tick data consists of hundreds of terabytes, it used Retrieval Augmented Generation (RAG) to convert relational database information into data vectors. RAG technology not only enhances LLM performance but also facilitates the integration of multiple real-time asset price feeds, crucial for RLHF, within existing LLM context windows.

Sentiment Analysis

The second AI tech stack focuses on Sentiment Analysis. By leveraging a pre-trained 8 billion parameter Large Language Model (LLM), Bumper can analyze vast amounts of financial Natural Language Processing (NLP) data to gauge market sentiment with unparalleled granularity. Through fine-tuning and advanced NLP techniques, Bumper gains valuable insights into speculator disposition, allowing for a deeper understanding of market dynamics and trends.

Bumper’s pre-trained LLM ingests extensive financial NLP data, categorizing sentiment into detailed scores and distributions to provide a nuanced understanding of market sentiment. The model is fine-tuned using Bidirectional Encoder Representations from Transformers (BERT) to label opinions, attitudes, and emotions, with specialized NLP training to identify distinct financial vocabulary.

Bidirectional Encoder Representations from Transformers (BERT) is a state-of-the-art natural language processing (NLP) model developed by Google. It is designed to understand the context of words in a sentence by looking at both the words before and after the target word, rather than just the words that precede it. This bidirectional approach allows BERT to capture the full context of a word, leading to more accurate interpretations of meaning.

Equipped with attention mechanisms that allow the model to weigh the importance of different words in a sentence when determining the contexts and transformer-based structures, the LLM effectively discerns market sentiment and investor behavior, signaling future market trends.

Technical Analysis

The third AI tech stack focuses on Technical Analysis. Bumper is developing a novel approach by training a Large Language And Vision Assistant (LLAVA), a multimodal model that combines vision-based analysis of price plot images with NLP-driven interpretation of technical indicators. This integration enables Bumper to make informed decisions based on historical price data and market trends.

The process consists in converting historical Bitcoin price data into graph plot images. These images are then labeled with technical markers such as support/resistance levels, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD). The LLAVA model processes both these visual data points and the associated NLP technical indicators.

This end-to-end multimodal model connects a vision encoder with a Large Language Model (LLM), allowing the system to analyze and interpret complex market data. Additionally, the model incorporates Long Short-Term Memory (LSTM) for historical time series prediction, enhancing its ability to predict future market movements based on past trends.

Important Links

If you’re finding this information useful, you can access our full Bumper Industry Intel for FREE.

Our full ~15 page report goes over the intricacies of the Bumper protocol, how Crypto and AI may intersect, & more…

Click below to get started:

Become a Premium member to unlock all our research & reports including access to our members-only discord server

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $116.58/month you’ll get:

Premium access to the entire Revelo Intel platform

Members Only Discord server

Market Intel - actionable trade ideas

Industry Intel - important trend & narrative overviews

Project Breakdowns & Timelines - Deep dive 50+ page protocol-specific reports

Notes - Summaries of your favorite podcasts & AMAs