Corn - ETH L2 with $BTC as Gas?: What You Need to Know

$6.7M Raise, Super Yield Network, $CORN Airdrop, & More

In our coverage across platforms, whether it be our newsletter, website, or X, we’ve been pretty vocal about ETH’s struggles vs the other majors. As an asset, it significantly underperforms the other majors, including BNB. Recently there has been a lot of discourse around whether or not ‘L2s are ETH’, which mostly boils down to semantics. Under the lens of ETH price, L2s haven’t dramatically been a driving force despite their large and growing activity. L2s using ETH as gas has helped to maintain the status quo of denominating in the asset though. ETH still plays an instrumental role in lending protocols, stablecoins, DEXs, and more. But as more people come to question ETHs role in a portfolio compared to the other majors that have clear theses, demand for L2s and other products that use Ethereum in some capacity but don’t require ETH holdings may grow.

By default, all L1s typically denominate in their native coin. This has helped to maintain the idea of the fat protocol thesis, proclaiming that, unlike Web2, infrastructure-level assets would continue to see the most value accrual in crypto as opposed to application assets. There’s been some movement to use stablecoins, for example on some NFT marketplaces, but native coins are still the driving force behind pricing and stablecoin purchases mostly serve as a way to avoid manually swapping before buying. As seen with Blast, seemingly simple ideas like providing native yield that is just stETH or sDAI, can go a long way, especially when combined with incentives. In today’s edition, we’ll be focusing on Corn, an ETH L2 that uses BTC for gas.

Stay alert, stay informed ⬇

RedStone is a rising star in the Oracles space, providing frequently updated, reliable, and diverse data feeds for dApps and smart contracts across chains, appchains, rollups, and more. The protocol has also recently placed focus on its Oracles Extractable Value (OEV) solution…

Background on Corn

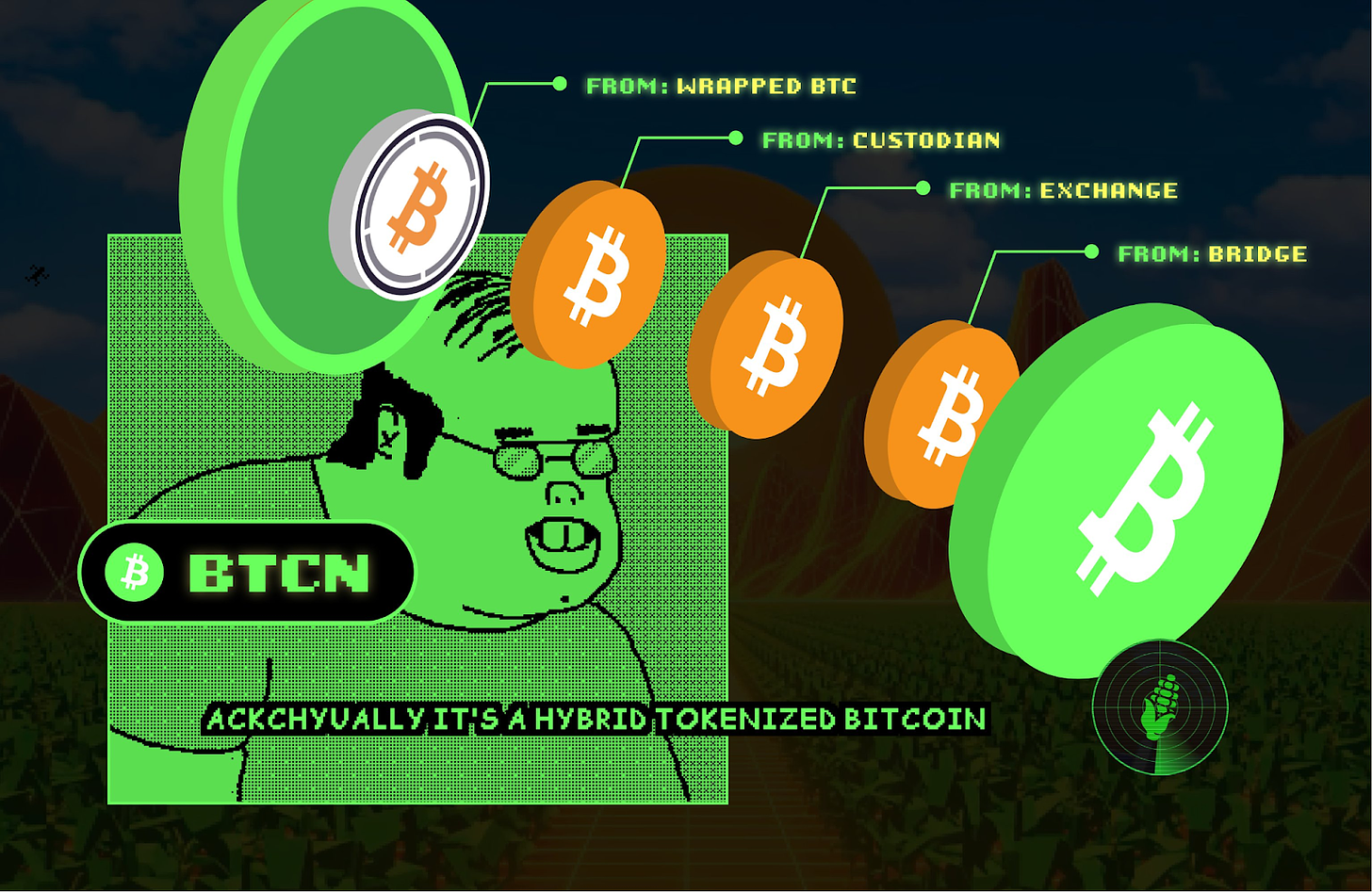

As mentioned above, Corn’s premise is relatively simple; the chain introduces BTCN, its hybrid tokenized BTC solution, backed 1:1 with native BTC and used as gas on the Corn L2. Various protocols, exchanges, and custodians are used to issue BTCN to try and mitigate centralization concerns, as seen with Blast for example.

Corn is a very young project, exiting its stealth mode just hours ago after announcing a $6.7M seed round led by Polychain with participation from Binance Labs, Framework Ventures, and more. There aren’t too many materials circulated yet, but the L2 could be interesting, especially after seeing the success of Blast. A similar playbook is alluded to, including simple tweaks to native assets, and a playful attitude with lots of incentives and yield being teased. Moreover, the chain also is looking to use its BTC-as-gas concept to further align incentives between users, developers, and investors, a common problem in crypto that many try to solve in various ways.

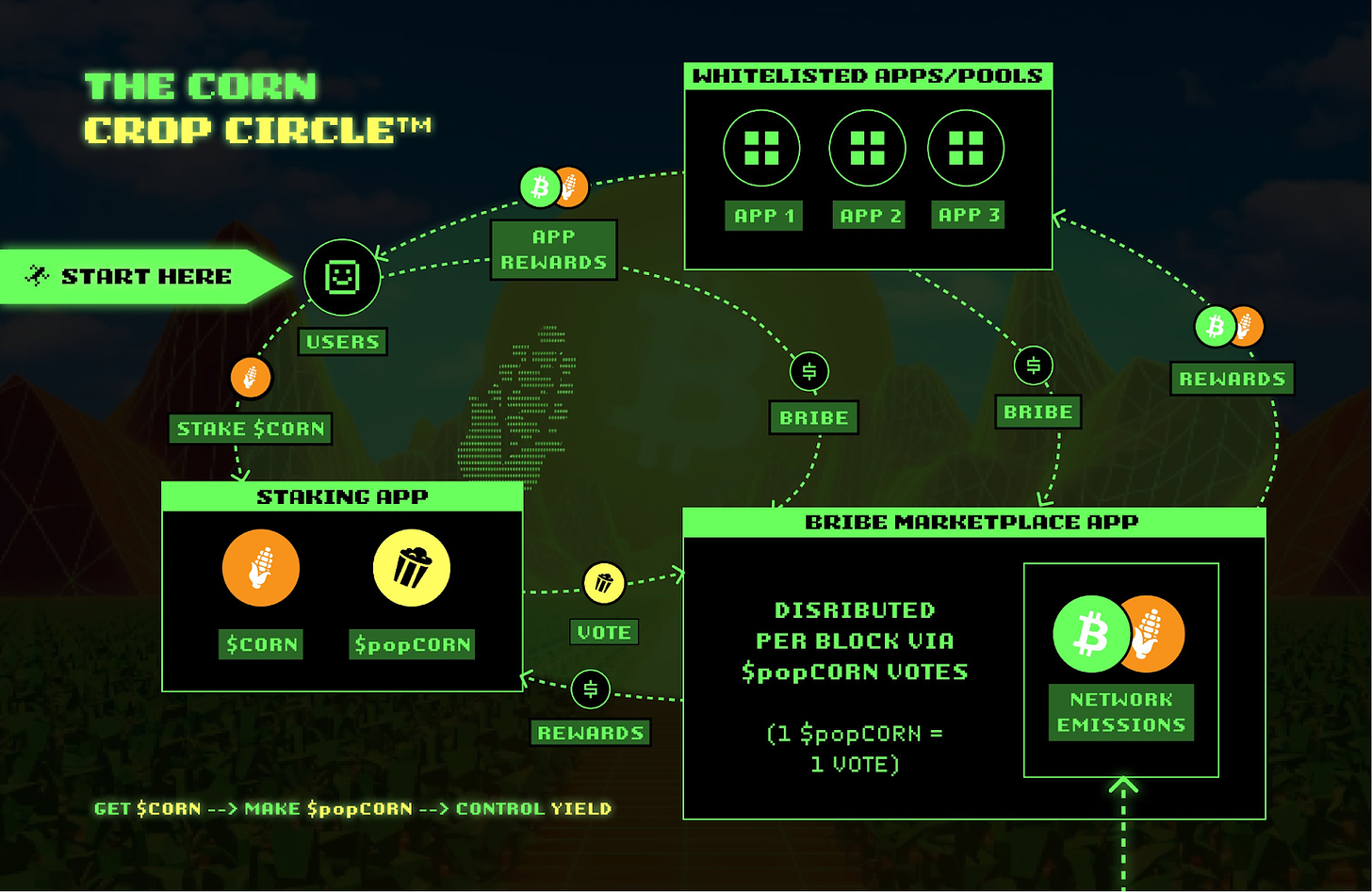

Corn describes itself as the ‘super yield network’, taking inspiration from ve-tokenomics. Each network block emits CORN incentives which CORN stakers (staked corn = popCORN) can then allocate to certain protocols as they see fit. CORN stakers also receive some BTCN rewards, derived from network fees. Somewhat similar to Berachain’s PoL system, Corn embeds tokenomics into the inherent nature of the blockchain.

Seeing that CORN is natively embedded into the very function of the chain, an initial CORN airdrop is slated to happen before the L2’s mainnet goes live. This also alleviates some community concerns around future airdrops being held above their head. More details about this airdrop are to be provided soon. A list of DeFi power users who have interacted with partner applications will determine eligibility. In addition to whatever projects are already planning on deploying on the L2s, an incubator program has been teased. Again, we see tactics similar to the likes of Blast and Berachain, with their Blast; Big Bang, and Build-a-Bera initiatives, respectively. This is about all of the information that has been made public around Corn so far, with an X space on August 22 teased as the next dose of details, specifically around airdrop information.

Important Links

Become a Premium member to unlock all our research & reports including access to our members-only discord server

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $116.58/month you’ll get:

Premium access to the entire Revelo Intel platform

Members Only Discord server

Market Intel - actionable trade ideas

Industry Intel - important trend & narrative overviews

Project Breakdowns & Timelines - Deep dive 50+ page protocol-specific reports

Notes - Summaries of your favorite podcasts & AMAs