DePlan - Put Unused Subscriptions to Use: What You Need to Know

Tokenized Subscription Hours, $DPLN, & More

With EthCC in the books, it’s onto the next narrative. Something that was exclaimed by industry leaders was a noticeable lack of applications in the Ethereum ecosystem this time around. Most if not all of Ethereum’s major innovations have been on an infrastructure level. Following the merge in 2022, liquid staking and LSTs became the new hot narrative. Market participants realized there’s no real advantage to holding native ETH and having your share of the network diluted away when minimal protocol risk can be absorbed by using a major liquid staking service provider and earning yield in the background all the while still. Not to mention additional utility retained from being able to use LSTs in DeFi. And then came the advent of restaking and LRTs, the infrastructure of which took a backseat to the yieldification and airdrop campaigns associated with farming points programs and using protocols like Pendle, Gearbox, and more to accumulate points faster.

It wasn’t EigenLayer AVS’s but rather the speculative chasing of restaking and LRT points that saw massive inflows into Ethereum mainnet, rejuvenating protocol TVLs and adding a fresh $15B+ to the Ethereum ecosystem. Ethena of course also joined the mix, still ranking ahead of Spark Protocol, Curve Finance, and more when it comes to mainnet TVL. Some of these airdrop games have deployed instances on L2s, enabling more users to participate. Now the majority of these programs have wrapped up or moved onto subsequent seasons, with points mostly in the rearview even considering upcoming catalysts to warrant ETH exposure.

Unlike last cycle, which saw the advent of DeFi primitives and a year later, NFTs, there seems to be a lack of Ethereum apps pushing the boundaries. The interesting things in the ecosystem, like SocialFi and social GameFi, have branched out to Blast, Base, and other L2s, despite very low gas prices on mainnet. This cycle, more novel usecases have sprung up on Solana. SOL might be most known to the masses as a chain to trade memecoins, but the chain also houses a collection of top-tier DePIN protocols, which we’ve covered extensively, from Parcl to Hivemapper, Helium, and more. In today’s edition, we’ll focus on DePlan, a Solana based protocol that creates a market of sorts for consumer subscriptions, an untapped area in crypto, and a unique niche to operate in…

Stay informed, stay alert ⬇

Ducata’s Arbitrum launch recently went live, bringing programmatic money directly to users. After raising $3M in the DCM pre-sale, the DUCA protocol debuted on Arbitrum this week. The team will initially boost yields for DUCA at launch for early participants…

Background on DePlan

DePlan, as the name implies, describes itself as pay-as-you-go protocol aimed at countering the payment subscription model. Recurring subscription models are a common business model; we operate one here at Revelo Intel. From dating apps to ChatGPT and everything in between, subscriptions have become a one-size-fits-all model for many types of businesses across industries. For the most part, consumers are OK with this. Typical features include annual plans which typically offer a discounted price compared to paying month-by-month, and a free or heavily discounted trial period that requires entering in credit card info to initiate automatic enrollment. Users may find the latter of these methods more irksome, with some people creating new accounts, sharing accounts, etc. to squeeze the most that they can out of a free membership. Sometimes people might even use groups on facebook or other platforms to purchase shares or rights to accounts P2P in increments shorter than a month.

This isn’t exactly a massive market, but having a formalized platform for this sort of thing could be solving an issue that people didn’t even know they had, as having unnecessary subscriptions is quite common, with some services even springing up just to notify users of recurring charges that may be lost across various credit card and bank statements. Apple’s app store notoriously labels charges as simply ‘apple’, making it hard to differentiate what is what. Of course, DePlan also takes a cut for itself to sustain operations. Almost everyone reading this has active subscriptions, and almost every active subscription never has all of its allotted hours used per month.

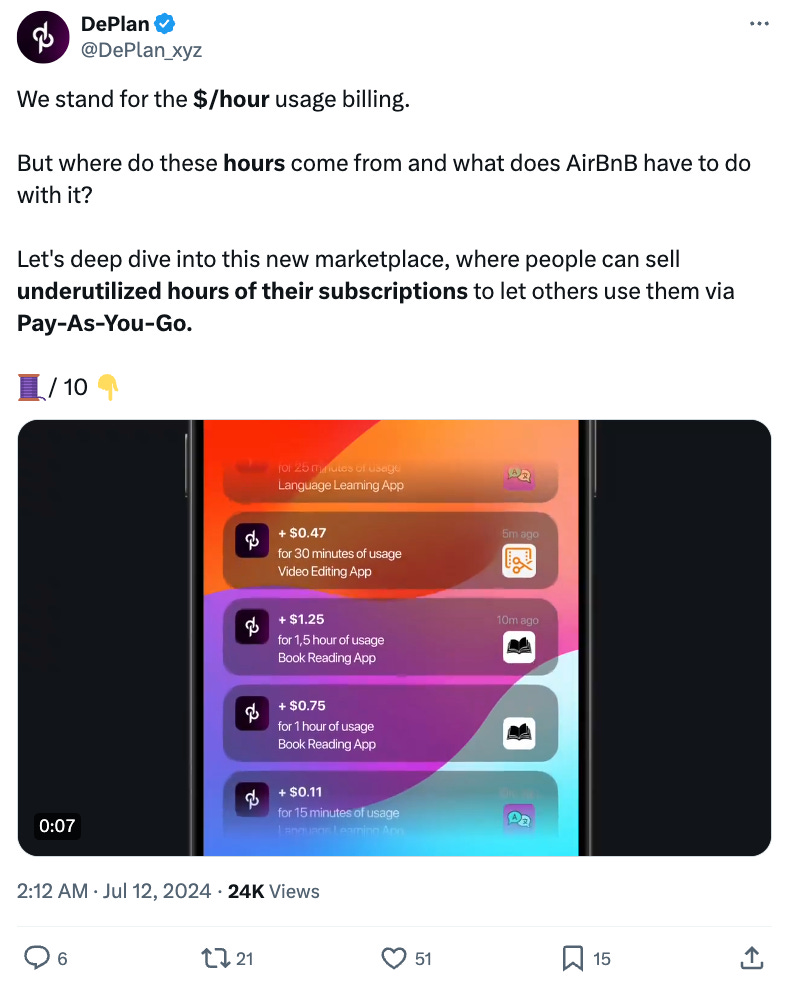

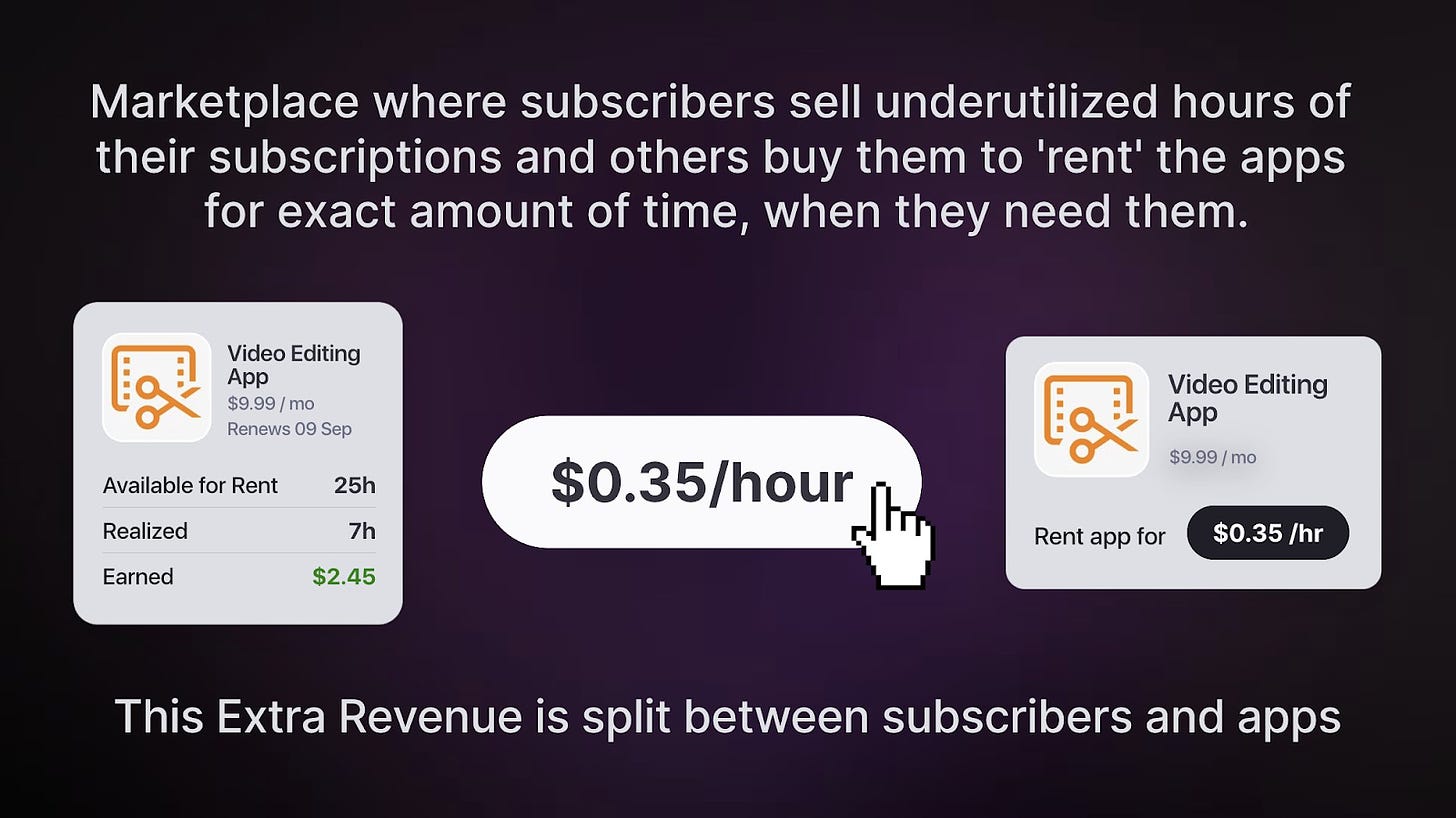

DePlan’s solution to this quiet-but-common problem is basically per-hour sub-leases of existing subscriptions. In the tweet above, the protocol likens itself to AirBnB as property owners, or even renters, which is more synonymous with membership subscribers, can let the market decide how much someone would be willing to pay for their property per night, instead of being locked into a month. Since there’s no overnight sleeping element with most app subscriptions, the segments are hours instead of days, which suits users. A crypto comparison could be protocols like Render or Akash, which provide more segmented cloud-compute, more flexible than offerings given by centralized providers like Amazon or Microsoft for startups that can benefit from these savings and pay based on actual use of the service provided.

DePlan tracks screen time to log how many hours out of the total hours in a given month a seller doesn’t use a specific app. Leftover hours are tokenized, and can be purchased on DePlan’s marketplace for an accepted price. This price cannot be set by sellers however, instead hours are automatically priced. First, the ‘real price’ must be found, by dividing the actual app subscription price by the average hours the app is used per month according to the platform. This aspect is sensitive to market fluctuations. Then, something called the ‘ideal price’ is calculated, found by dividing the actual app subscription price by the number of hours a buyer uses their purchasing device per month. The average of these two scores is the purchasing price per hour of a given app. This incentivizes buyers to use their phone as much as possible if they want to bring down their ideal price. Should DePlan gain popularity, you might even see buyers opting to tack a lot of hours onto one app to help bring its real price down. Prices are set by-the-hour, but users only actually pay per minute used.

Interestingly, DePlan also pays out revenue earned to the underlying app itself, in addition to the individual subscribers. This could see more use and popularity for partnering apps, incentivizing them to integrate DePlan and in turn, help the protocol make a name for itself.

Given the way that prices are calculated and unproven demand for tokenized subscription hours at this stage, it’s unlikely that anyone will be making large sums per month from their unused subscriptions. But at the least, DePlan is an interesting non-speculative protocol coming together at a time when crypto could use more projects in this sphere. Also considering DePlan has its own debit card offering cash-back rewards for subscription purchases, the project can be something cool for people to play around with and maybe leave on autopilot to recoup some money lost each month on subscriptions. After all, people do go to great lengths using VPNs and global debit cards to get lower subscription rates in other countries; DePlan could be a simple way to get some return on an asset that everyone has. Not to mention the fact that the $DPLN token is already live, sitting at a marketcap of ~$650K and an FDV of ~$21.5M. While a lack of a points program might detract from the protocol, the token being live provides an element of speculation that is otherwise mostly missing from the practical project.

Important Links

Become a Premium member to unlock all our research & reports including access to our members-only discord server

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $116.58/month you’ll get:

Premium access to the entire Revelo Intel platform

Members Only Discord server

Market Intel - actionable trade ideas

Industry Intel - important trend & narrative overviews

Project Breakdowns & Timelines - Deep dive 50+ page protocol-specific reports

Notes - Summaries of your favorite podcasts & AMAs