Delphi Labs, the R&D arm of Delphi Digital recently announced they would be building primarily on a new ecosystem.

The Labs team was previously focused on the Terra ecosystem. Following it’s implosion, Delphi decided to spend a significant amount of time researching different ecosystems to figure out which is the best fit for their crypto thesis. The culmination of this research is this article, by Delphi Labs team members Can Gurel, Jose Maria Macedo, and Luke Saunders.

Read our notes on the Delphi Labs research report below to find out where Delphi will be focusing its attention, and learn more about the thought process behind its decision.

Short Background on Delphi Labs’ Team

Begun covering DeFi for research business in 2018.

Started investing in DeFi via Ventures in 2019.

Consulted world-class DeFi pioneers.

What the DeFi End-Game Experience Might Look Like

The DeFi UX will eventually be rebundled into a single, vertically integrated UX (spot trading, lending&borrowing, leveraged trading, etc.).

DeFi credit lines can facilitate the creation of a “Universal DeFi credit account”, which users can use to perform leveraged interactions with whitelisted DeFi apps with a single account-level LTV.

Two views of how crypto will end up

“Monolithic” view - all activity will converge onto a single general purpose execution environment.

“Multi-chain view” - There will be a large number of specialized execution environments, each with its own design and tradeoffs.

A wide spectrum of views between these two extremes.

The team believes that projects will increasingly opt for specialization, with crypto becoming more multi-chain.

There are three key benefits to specialization: lower/more predictable resource costs, customizability, and sovereignty.

Lower/More Predictable Resource Costs

With the assumption that demand for block space is elastic

Demand for block space is likely to outstrip supply, with costs rising, regardless of the speed of a monolithic chain.

An application on a monolithic chain constantly competes for block space which leads to network congestion and it results in high fees or chain halts.

dApps on monolithic chains will:

Face increasing costs over time, as more activity moves on-chain.

Face greater uncertainty regarding resource costs, since this depends on the demand for block space from other dApps.

These trade-offs won’t make sense for many applications e.g. gaming. If tx costs spike because of a popular NFT mint, the game may become unplayable for its users.

Customizability

Optimize trade-off space

An application-specific chain can tune its scalability trilemma strategy based on the needs of that application.

If a game cares less about decentralization/security it can be run by a smaller or permissioned validator set.

DeFi Kingdoms sacrificed security for cheaper gas by moving to its own subnet.

State machine customization

Platforms can customize all aspects of their state machine including mempools, transaction propagation, etc. (can be used for custom fee models, custom MEV solutions). Cosmos compatible protocols such as Osmosis and dYdX implement custom fee models, while both Osmosis and THORChain and Osmosis implement their own strategies to limit MEV.

Performance/scalability optimization

Parallel execution to process transactions that don’t touch the same state, thus increasing scalability, for example, Solana, Sui, Aptos, and others.

Validators taking on additional services

Validators supporting IPFS pinning services.

Validator-secured bridge to ETH.

Mempool/consensus customization

DAG (Direct Acyclic Graph)-based mempool design that can provide availability and casualty guarantees reducing the work for a consensus algorithm.

dYdX makes its nodes do off-chain computation achieving greater scalability.

Celestia makes erasure coding part of its block production process by using ABCI++.

Privacy

Data can be kept secure and anonymous by using Intel SGX enclaves in a TEE as it’s done by Secret Network.

Penumbra is integrating threshold encryption directly into consensus allowing them to do things like shielded swaps.

Value capture

In blockchains, value is leaked to the underlying protocol layer in the form of fees and MEV.

The team believes that the biggest dApps may become larger than any single L1. These dApps will own the user relationship that’ll allow them to vertically integrate into their own specialized L1s.

Sovereignty

New features on the underlying blockchain can potentially harm UX of smart contracts because the governance of the smart contract ultimately relies on the governance of the blockchain.

Drawbacks of Specialization

Launching a standalone chain is more expensive and time-consuming than simply deploying smart contracts on an existing chain, however, the gap continues to narrow.

Lack of synchronous composability, however, there are only a few applications that truly benefit from this.

Specialization doesn’t mean deploying a chain with a single app on it. It can be a cluster of apps that facilitate a certain use or synergize well together.

The team believes that the space will evolve into a mesh network of interconnected specialized chains organized into clusters around specific use cases.

Cross-Chain Architecture

The first way is with stand-alone deployments that do not communicate with each other (Aave, Uniswap, Sushi, Curve).

The second method involves all liquidity sitting on one unified app-chain (Thorchain, Osmosis).

Delphi Labs is exploring a third way where application instances would be deployed on multiple chains (outposts) but connected by leveraging a coordination layer that facilitates communication and liquidity allocation between outposts.

Platform Requirements

Speed should be as close as possible to a CEX.

Ecosystem - composability and the number of integrations a DeFi super-app can provide are the advantages over a CEX.

Other factors that matter in selecting the right platform are decentralization, cross-chain interoperability, technical maturity, and portability of code.

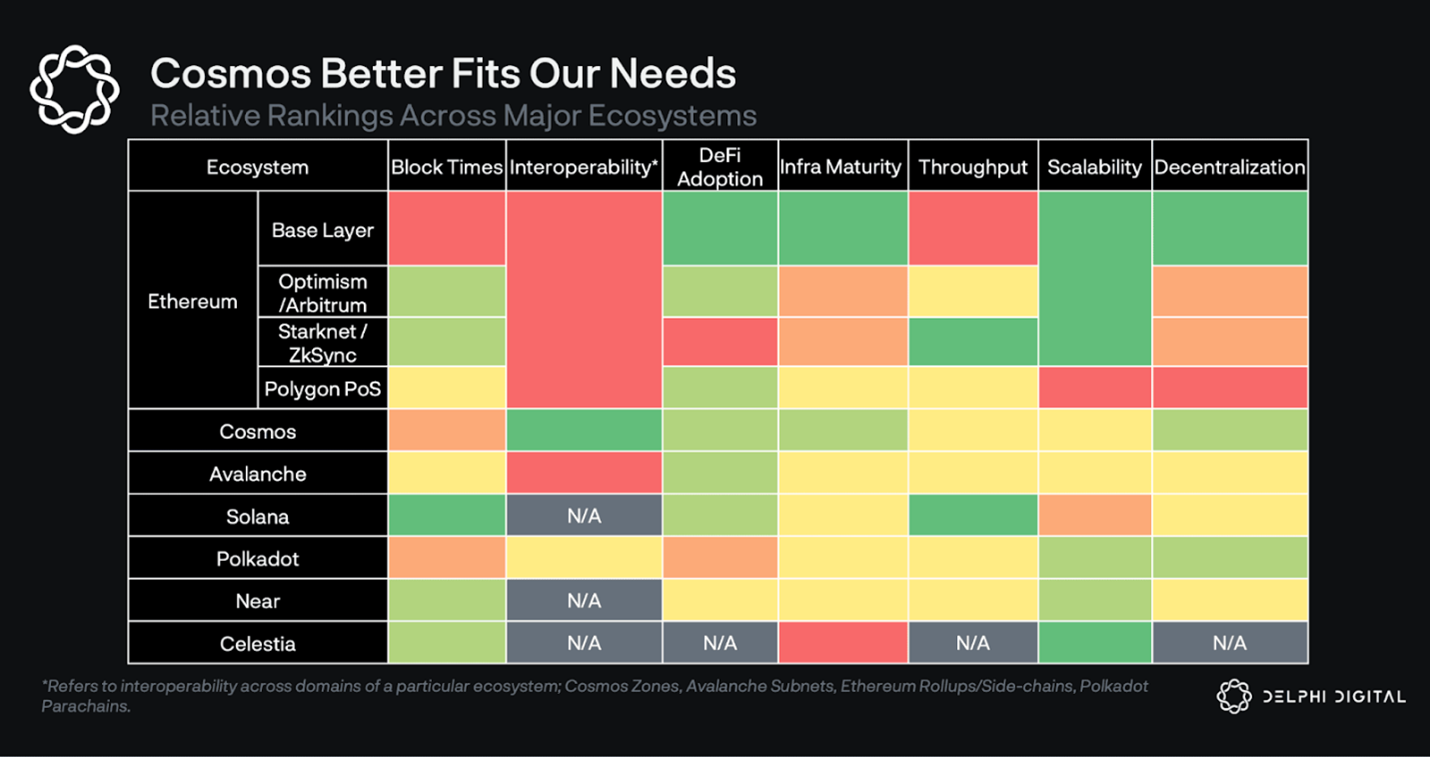

Ecosystem Comparison

The team compared the blockchains based on the factors given above. Below is an image of the summary.

Other Chains: Aptos and Sui:

Similar to Solana, both will likely perform and scale very well by maximiz throughput, utilizing a Direct Acyclic Graph (DAG). High-performance chains reduce the demand for other alternative chains.

Sui and Aptos use the MOVE language.

These high-performance chains will start off with the same issues other chains have today: lack of adoption, from users, dapps, and bridges.

Conclusion: Cosmos

Cosmos is best positioned to benefit from the increasing number of app-chains and enable the most advanced cross-chain architectures.

The chain is fast and it would enable a seamlessly integrated DeFi UX with order books, high leverage, and fast trading execution.

It has the potential for strong security, liveness, and censorship resistance because of its sufficient decentralization.

Cosmos’ weakness is the ecosystem where its current TVL is lower than single ETH L2.

Other negative aspects would be the lack of hype, funding, and memeability.

In addition to Cosmos, the Delphi team will also monitor other chains to see if adoption is proving their thesis

Important Links

Follow Revelo Intel for More Notes like this

Read the Original Announcement Article