DePIN is quickly catching on as one of several key narratives, particularly on Solana. With projects like Render and Helium making significant moves, it’s well worth researching DePIN and the genre’s associated projects.

In this edition we’re briefing you on io.net, a project that aggregates idle GPU compute power to create GPU clusters with more competitive pricing.

Stay alert, stay informed ⬇

Crypto Market Update:

- Top Gainer (24H) in the top 50 mcap: Cosmos Hub $ATOM, increased 17.8%.

- Top Loser (24H) in the top 50 mcap: Leo Token $LEO is down -7%.

- Total crypto market cap has seen a decrease by 0.25% to stand at $1.52T.

- BTC dominance in the market is currently at 53.1%.

- Median gas price on Ethereum over the past 24 hours has been 43 gwei.

News:

- Presidential Candidates Discuss Cryptocurrency: At a recent event, U.S. presidential candidates Asa Hutchinson, Vivek Ramaswamy, and Dean Phillips delved into cryptocurrency issues, with Ramaswamy highlighting the Tornado Cash case.

- El Salvador Approves Bitcoin Bonds: El Salvador's "Volcano Bonds," backed by Bitcoin, have received regulatory approval for issuance in early 2024, marking a significant step in the country's crypto journey.

- KuCoin Settles with New York for $22 Million: Crypto exchange KuCoin agrees to pay $22 million and exit New York to settle a lawsuit alleging securities law violations.

- Binance Ends Ruble Support on P2P Platform: Binance will cease supporting the ruble on its P2P trading platform as it exits Russia, with users needing to withdraw funds or transfer them to CommEX by Jan. 31.

- Trump Launches New NFT Collection: Donald Trump's new $99 "Mugshot Edition" NFT collection causes a stir in prices for his previously issued NFTs.

- DOJ Charges Two in Crypto Ponzi Scheme: The US Department of Justice charges David Saffron and Vincent Mazzotta for operating a $25 million crypto Ponzi scheme under various false entities.

Project Updates

- Solana's mSOL Token Experiences Brief Price Plunge: Marinade Finance's mSOL token on Solana dropped 18% due to a large sale by a whale, but quickly rebounded in price.

- Polygon Integrates Celestia for Layer-2 Development: Polygon adds Celestia's data availability solution to its Chain Development Kit, offering a cost-effective option for layer-2 network developers on Ethereum.

- Synthetix Ends SNX Token Inflation: The Synthetix community approves SIP-2043, halting SNX token inflation and shifting to token buybacks and burns as part of its new strategy.

- Aptos Releases $200 Million in APT Tokens: Layer 1 blockchain Aptos unlocks 24.8 million APT tokens, representing 8.9% of its circulating supply, impacting the market and its stakeholders.

- Starknet's "Devonomics" Program to Reward Developers: StarkWare and Starknet Foundation will distribute 10% of Layer 2 network fees, totaling over $35 million in ETH, to developers on Starknet.

- Hut 8 Acquires Power Plants for Bitcoin Mining: Hut 8, post-merger, expands by acquiring four Canadian power plants and a new bitcoin mining site to boost its growth and diversify operations.

- Clearpool Launches Credit Marketplace on Optimism: Clearpool introduces Clearpool Prime, an institutional credit marketplace on Ethereum rollup Optimism, targeting the $1.4 trillion private credit market.

Background on io.net

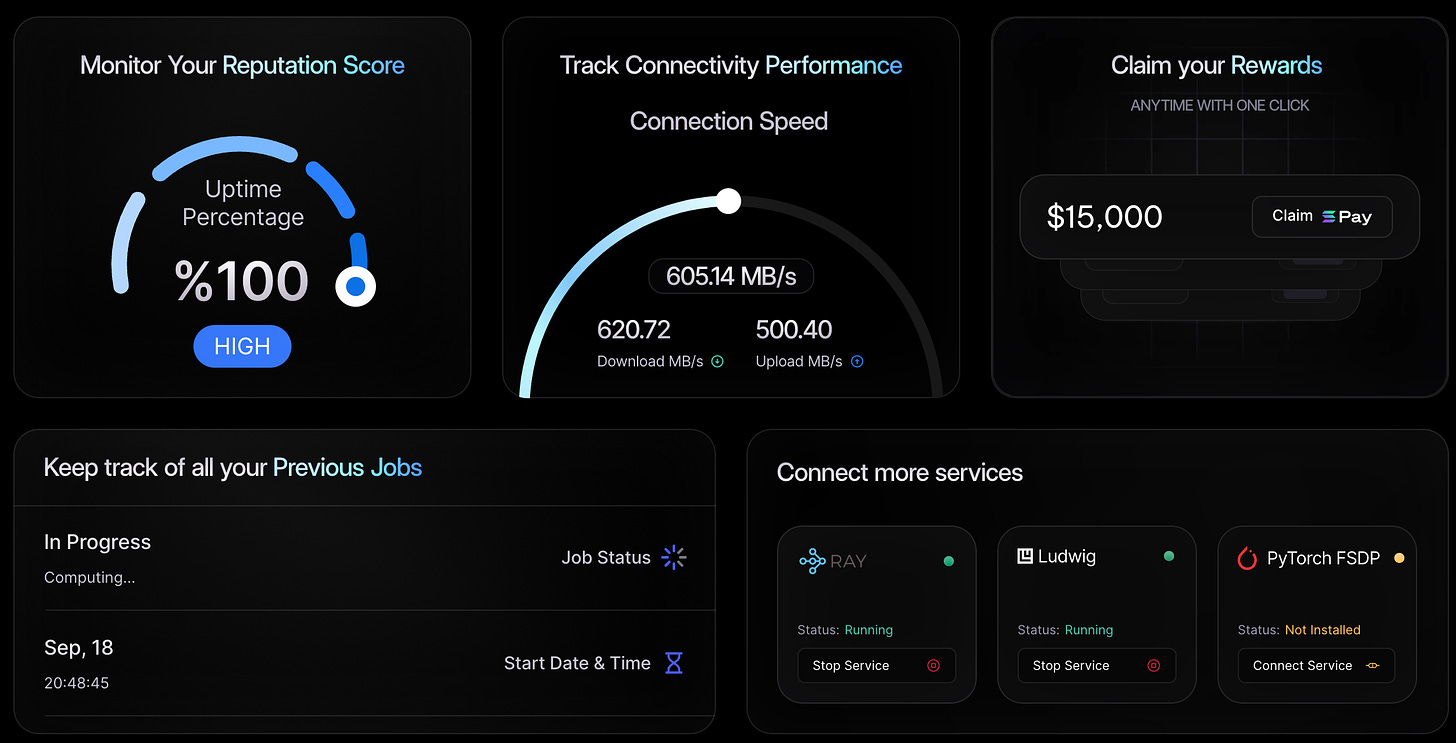

io.net is a DePin protocol that helps solve coordination problems between GPUs, built on Solana.

Similar to how DeFi disrupted traditional finance by cutting out middlemen and pulling liquidity together, io.net aims to do the same with compute resources.

It provides a coordination solution where all participants are incentivized to work together.

io.net identifies inefficiencies in the market, such as supply constraints and centralization of control over GPUs.

By addressing these issues, io.net aims to provide a cheaper offering compared to centralized services.

What is DePIN?

DePin refers to a collective effort to replace existing infrastructure through hardware investments and incentivization with tokens.

Examples include 5G networks, routing 5G through people, and replacing traditional telecom infrastructure.

Hardware participation in networks brings value to people.

Why is DePIN growing on Solana?

Solana's friendly and supportive community fosters growth and collaboration.

The blockchain offers tools for microtransactions, data storage, and other features.

The combination of community support and useful tools makes Salana an ideal platform.

DePin represents what blockchains are made for.

GPU space is dominated by oligopoly, highlighting the need for disruption.

DePinprojects have the potential to bring significant changes to various industries.

There is a growing number of crypto applications focused on merging offchain tokens with real-world economic output, particularly based on Solana.

Render is creating a peer-to-peer network that enables GPU rendering tasks to be completed using idle GPUs. Render is actually one of the sources that io.net aggregates GPUs from.

Hivemapper aims to develop the world’s most up-to-date & AI-powered map, by rewarding contributing drivers with dashcams in $HONEY tokens.

Helium incentivizes users to provide local hotspot coverage in exchange for native $HNT tokens.

Shdw drive is a decentralized storage solution involving the native $SHDW, similar to the likes of Filecoin, Arweave, etc.

Team Behind io.net

Ahmad Shadid is the founder and CEO of io.net.

Ahmad says that before io.net, Ahmad developed a machine-learning model to detect institutions trying to fill orders in the market and hide them.

He scaled the model to cover 2,000 stocks and 150 cryptocurrencies.

Tory Green is the COO and CFO of io.net, starting full-time three months ago.

He started with a corporate career, including banking, private equity, and corporate strategy roles.

He co-founded a digital publishing firm during the web2 era.

He transitioned from being an investor to an operator, helping portfolio companies with sales, marketing, finance, operations, and strategy.

He spent almost two years as CEO & CFO of Hum Capital, a machine learning company. He gained insights into the AI space during this time. He has been personally interested in crypto since 2016.

Tory says that he recognized io.net as a deep-end solution solving real problems. He was impressed by the qualities of Ahmad, including intelligence, vision, and drive. He joined io.net full-time three months ago due to his belief in its potential.

io.net vs legacy competitors

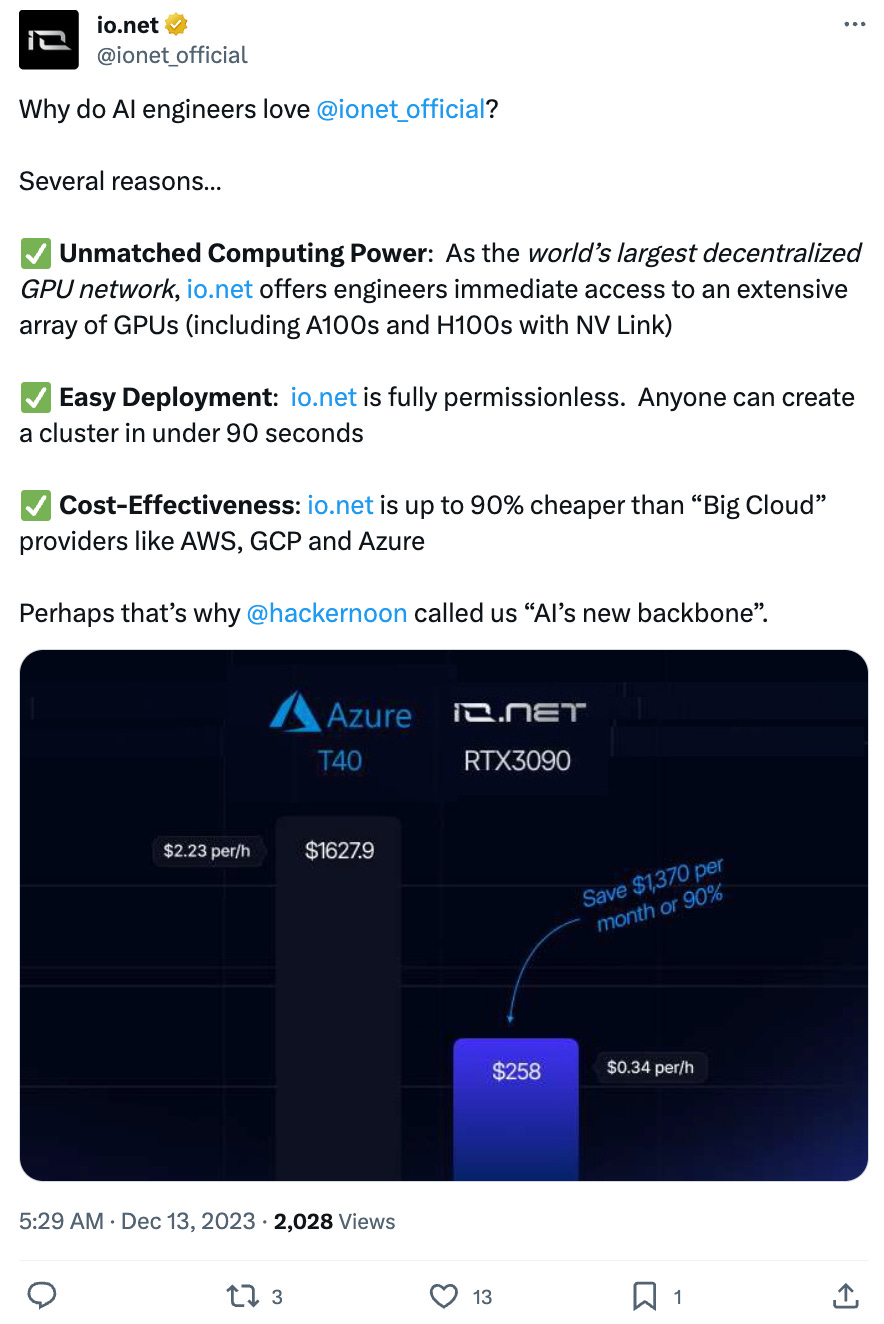

Price is a significant advantage compared to competitors, but there are other differentiators.

io.net offers a choice - users can recreate an AWS-like data center with comparable performance.

Users can bring data centers closer to their location for lower latency, providing a competitive advantage in trading scenarios.

Active GPUs by location

Tory says that io.net’s UX is superior compared to deploying on AWS, which often involves complex processes and certifications that take months.

Ahmad says that io.net offers GPU speeds faster than Lambda Cloud's 40,000 or 80,000 GPUs.

Startups are switching from Lambda Cloud to io.net due to faster internet speeds and better networking performance.

Small details like internet speed matter - providers with fewer servers can offer higher speeds due to less network congestion.

io.net aims to tap into the profitability of AI computing, similar to AWS.

By attracting more GPU suppliers, the network can offer consistent profits to suppliers and grow its client base.

Ahmad says that clients don't have to move everything from AWS but can benefit from lower prices, comparable performance, and improved user experience.

The network's growth could eventually lead to building cloud source data centers and additional resources.

Are there tradeoffs to using io.net?

Legacy competitors may argue that io.net lacks certain features like auto-deployment, CI/CD, API defense, etc., which they took years to develop.

Ahmad brings up that io.net is already building these features within the ML industry for training and inference purposes.

He adds that while there may be some tradeoffs in terms of the feature range currently available, io.net offers a superior overall experience compared to legacy providers.

Ahmad says that with their platform, users can easily access a wide range of GPU supply in 45 countries.

No questions asked, simply click deploy and within 10 seconds, the deployment is complete.

Traditional methods with AWS or other providers often involve begging for GPU access by submitting pitch decks and LinkedIn profiles.

Ahmad shares how as a developer, he was hurt by being asked for pitch decks and LinkedIn profiles when all they wanted was access to GPUs.

Their platform aims to bring power back to engineers by simplifying the process and eliminating unnecessary requirements.

They provide a supportive community on Discord where engineers can seek help from others who are deploying with them.

Ahmad adds that by engaging with the community and providing support, they aim to create a better overall user experience for engineers. This approach aligns with the needs and mentality of the current generation of developers who value simplicity and accessibility.

He adds that there is an emerging market driven by startups that are willing to invest significant amounts of money into accessing compute resources.

This generation is building innovative solutions, making it crucial to cater to their specific needs and ways of working.

Their platform aims to change the dynamics of the market by bringing supply on-demand.

What is GPU Clustering?

io.net’s technology allows for clustering 50,000 to 70,000 GPUs into a single cluster.

This clustering capability sets io.net apart from competitors who typically offer individual GPU instances.

The networking infrastructure built by io.net enables efficient communication between clustered GPUs.

There is a possibility of building large language models through platform if users have sufficient resources.

The product is designed to cater to those who are building on a specific infrastructure, targeting clients who have the financial resources but struggle with costs.

The team recognizes the importance of aligning with clients.

The product has been demoed to prominent companies like OpenAI, Instacart, and Uber.

Ahmad expresses confidence in targeting specific clients due to their size and potential for revenue generation.

He anticipates a substantial influx of money into the network as more startups join.

Transactions can be made using traditional payment methods like Visa, without users needing to know anything crypto-related.

The goal is to attract clients who book GPUs for longer periods (e.g., six months) to maximize earnings.

He foresees a network where money flow surpasses token emission.

Tory considers competitors as either suppliers or aspiring suppliers rather than direct rivals.

He asserts that they are uniquely positioned to serve Enterprise AI customers.

There are network fees ranging from 5% to 10% for various transactions within io.net.

io.net also comes complete with its own explorer.

Important Links

Become a Premium member to unlock all our research & reports including access to our members-only discord server

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $33.25/month you’ll get:

Premium access to the entire Revelo Intel platform

*NEW* Raise Alpha- Weekly reports on interesting project raises

*NEW* Sector Overviews - 90 day Reports with data and insights on key sectors

Launch Alpha - Weekly report highlighting new projects

The Trace - Real-time onchain alerts for smart money movements

Airdrop Guides - Reports on airdrop opportunities

Members Only Discord server

Analyst Insights reports - actionable trade ideas

Project Snapshots - Monthly protocol-specific performance reports

Project Breakdowns & Timelines - Deep dive 50+ page protocol-specific reports

Notes - Summaries of your favorite podcasts & AMAs