Polytrade RWA Marketplace: What You Need to Know

Multi-asset RWA Marketplace, Mastercard Partnership, $TRADE, & More

We’ve been discussing RWAs recently, as the sector may be one which benefits the most from institutional interest and inflows that are slowly-but-surely making their way to the crypto markets. Some RWA protocols are interesting in that they aren’t overly complex or novel in what they provide, instead using the permissionless and intermediary-free nature of blockchain to cut out middlemen that might take the form of credit card processing fees, realtor fees, etc. Projects like Kettle, a tokenized luxury watch trading protocol, have a pretty simple premise with enticing incentives layered on top to appeal more to the crypto-native crowd that is closer to the product than traditional users.

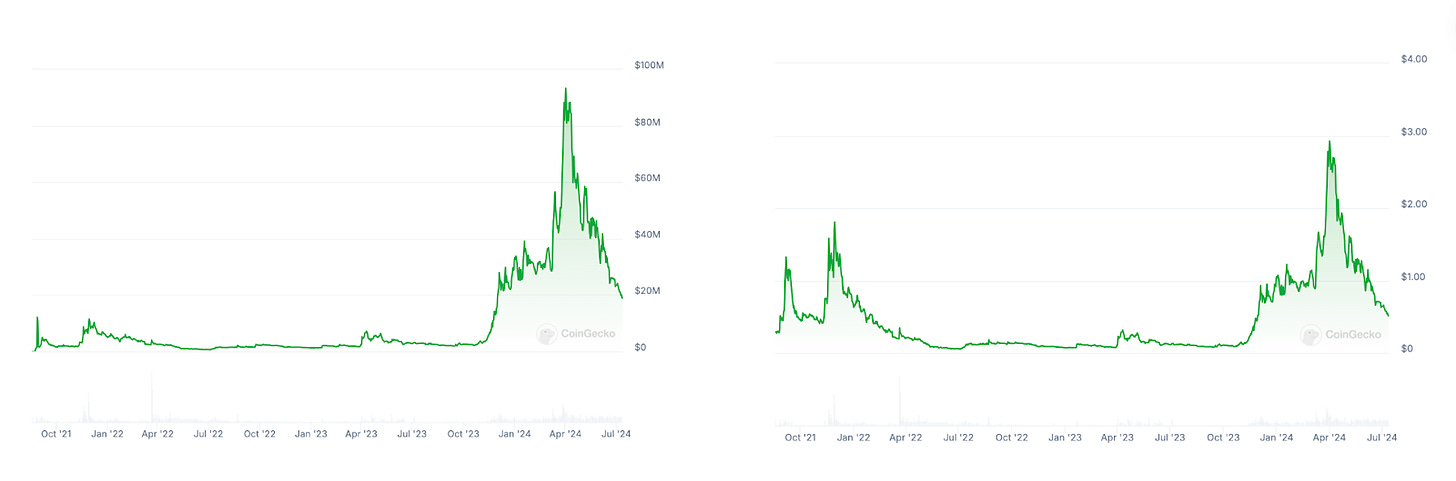

In today’s edition, we’ll be talking a bit about Polytrade. Polytrade is an RWA marketplace encompassing several distinct types of assets, including equities, heavy metals, real estate, and more. Polytrade has been around for a while, first raising $1.2M in 2021 and then another $3.8M round in 2023. Polytrade’s native TRADE token has actually been around for a while. TRADE actually doubled its ATH of the previous cycle, despite significant token inflation.

Ducata’s Arbitrum launch recently went live, bringing programmatic money directly to users. After raising $3M in the DCM pre-sale, the DUCA protocol debuted on Arbitrum this week. The team will initially boost yields for DUCA at launch for early participants…

Background on Polytrade

Polytrade acts as an aggregator for real-world asset projects in Web3, addressing the challenges of asset discovery and liquidity in the market. Polytrade’s platform can be described as a multi-chain product that enables discovery, purchase, and fractionalization of assets, thereby lowering entry barriers and increasing liquidity. The team envisions the platform becoming a one-stop solution for all things related to RWAs, offering a comprehensive ecosystem for diverse asset investments. From the start the platform’s focus was broad, encompassing various protocols, eventually enabling the trading of real-world assets like collectibles and real estate without the need for exchange KYC. The team plans to explore different asset types to understand user preferences and expand accordingly.

The marketplace entered its beta testing phase late last year with a select group of founders and experts. Now there is a goal of incorporating various interesting assets in the real-world asset (RWA) space, including financial assets, collectibles, and creator royalties. 2024 objectives include expanding to multiple chains and protocols, enabling cross-chain flow of funds and assets, and growing a large community interested in RWAs.

The team also draws a parallel between Polytrade and building an Amazon-esque marketplace for Web3, focusing on a variety of assets sold in one place seamlessly. This differs from the current state of crypto which is mostly hyper-specialized, out of necessity. In the RWA sector, some protocols specialize in luxury watches, others in agricultural commodities, etc. as developing the infrastructure to facilitate the trading of one type of IRL asset is cumbersome enough.

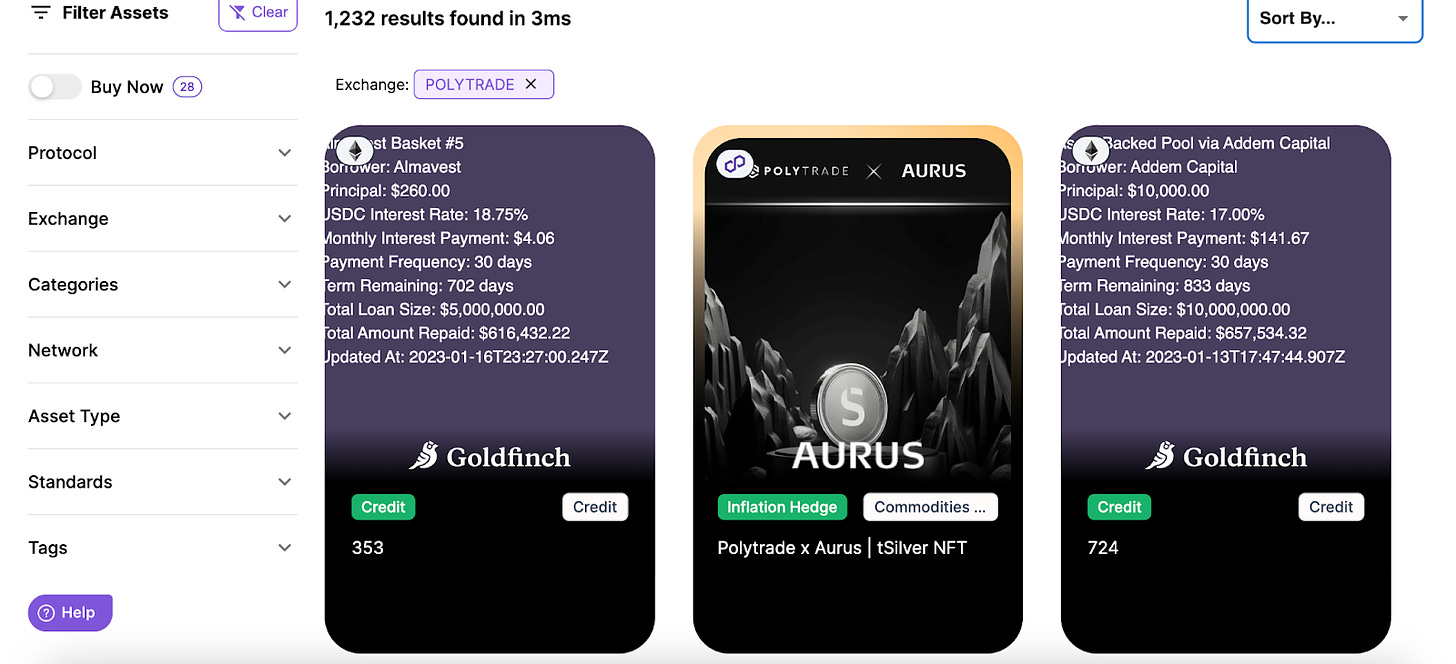

The platform currently has over 18K users, with over 3,800 assets available to trade, including luxury goods, alcohol, song royalties, credit, and more. Part of the wide variety of assets that can be traded comes from the fact that Polytrade also aggregates other protocols in addition to what is listed on its own marketplace. From OpenSea NFTs and song royalties on anotherblock to decentralized structured credit lending on Goldfinch, and more, there’s a breadth of options available.

“Polytrade's integration of DeFi with traditional finance represents a much-anticipated step forward in the evolution of the financial landscape. Given our longstanding relationship with the team, I am convinced that their unwavering dedication to real-world assets and DeFi will prove to be a transformative force for the web3 ecosystem and drive widespread adoption.”

-Sandeep Nailwal, Co-Founder of Polygon

Polytrade does have a loyalty XP program alluding that “greatness will be rewarded”. Users will earn XP proportionally aligned with the $ value of the asset they buy or sell, with a warning that fake trades will indeed be filtered out. Multipliers will be applied for certain assets, and early access users. There are additional badges that can be collected, providing XP multipliers as well as just bonus XP.

Polytrade is also affiliated with Mastercard, an incumbent financial company that many may not know expends a lot of resources in the crypto space. The credit and debit card services company most notably ended its Binance debit card agreement amidst regulatory uncertainty around the company. A similar but lesser-known partnership with Bitpay was also ended around the same time.

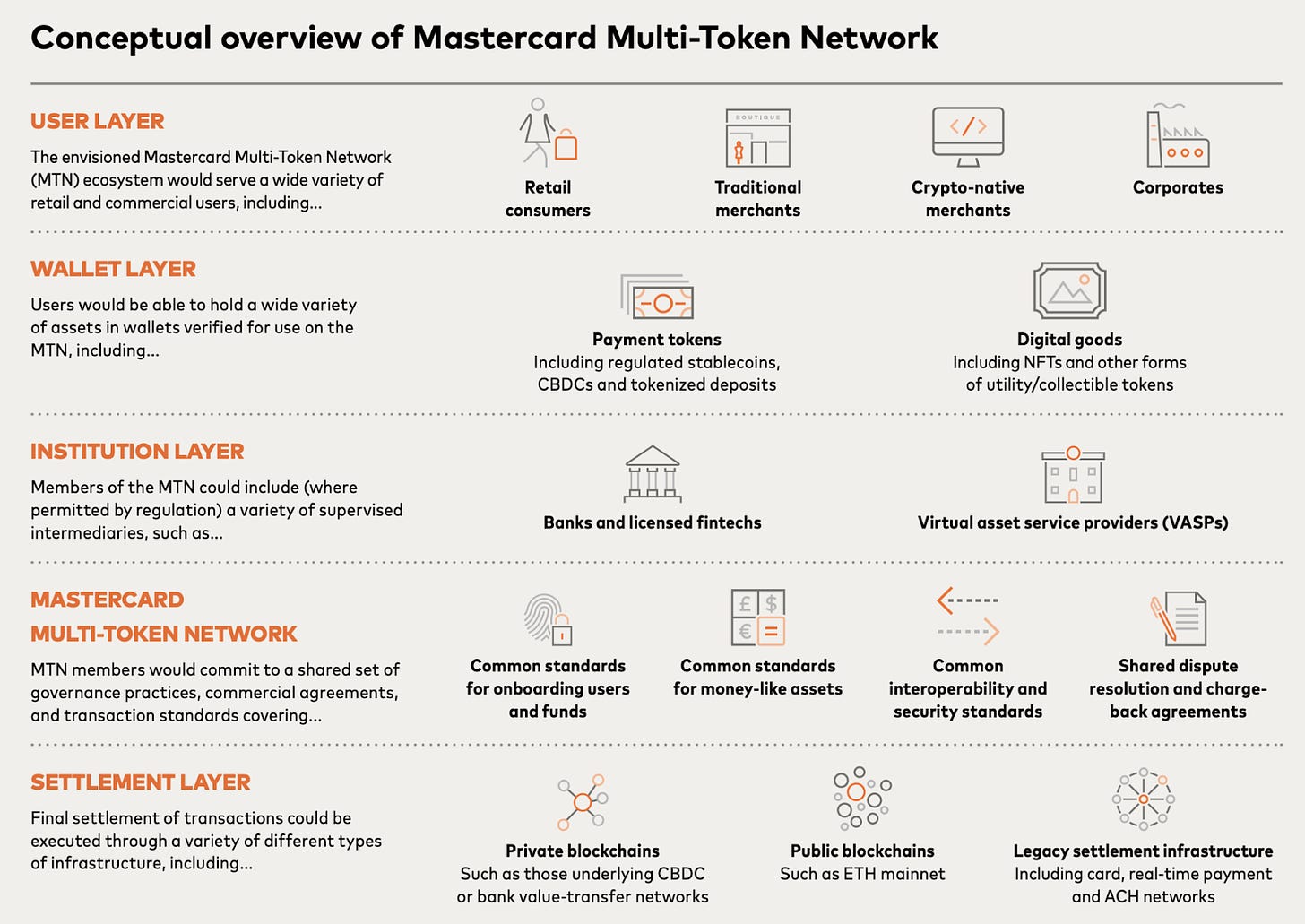

Despite these setbacks, Mastercard prioritizes being involved with early-stage crypto protocols and trying to develop its own blockchain infrastructure. Polytrade is a member of Mastercard’s start path program, which aims to aid fintech, blockchain, and other tech-focused startups with engagement and global support. Additionally, Polytrade was one of the first adopters of Mastercard’s Multi-Token Network (MTN) initiative. This infrastructure campaign aims to make blockchain more like traditional payment methods, enabling things like invoice payments and reducing reliance on specific chains.

As mentioned earlier, Polytrade does have a token, currently trading at $0.51, with a marketcap of nearly $19M and an FDV of over ~$51.4M. When it comes to utility, the token can be staked, for a 3.55% APR. The rewards, denominated in TRADE tokens, are pre-fixed, so this APR does decrease and increase as the percent of supply staked increases and decreases, respectively. There are currently 5M tokens staked, around 14% of the total current circulating supply, and users can withdraw their staked tokens at any time.

Important Links

Become a Premium member to unlock all our research & reports including access to our members-only discord server

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $116.58/month you’ll get:

Premium access to the entire Revelo Intel platform

Members Only Discord server

Market Intel - actionable investment reports

Industry Intel - highlighting important narratives/ trends

Project Breakdowns - Deep dive 50+ page protocol-specific reports

Notes - Summaries of your favorite podcasts and AMAs