Polytrader - Polymarket Trading AI? What You Need to Know

Agentic AI Alpha, Trading Assistants, & More

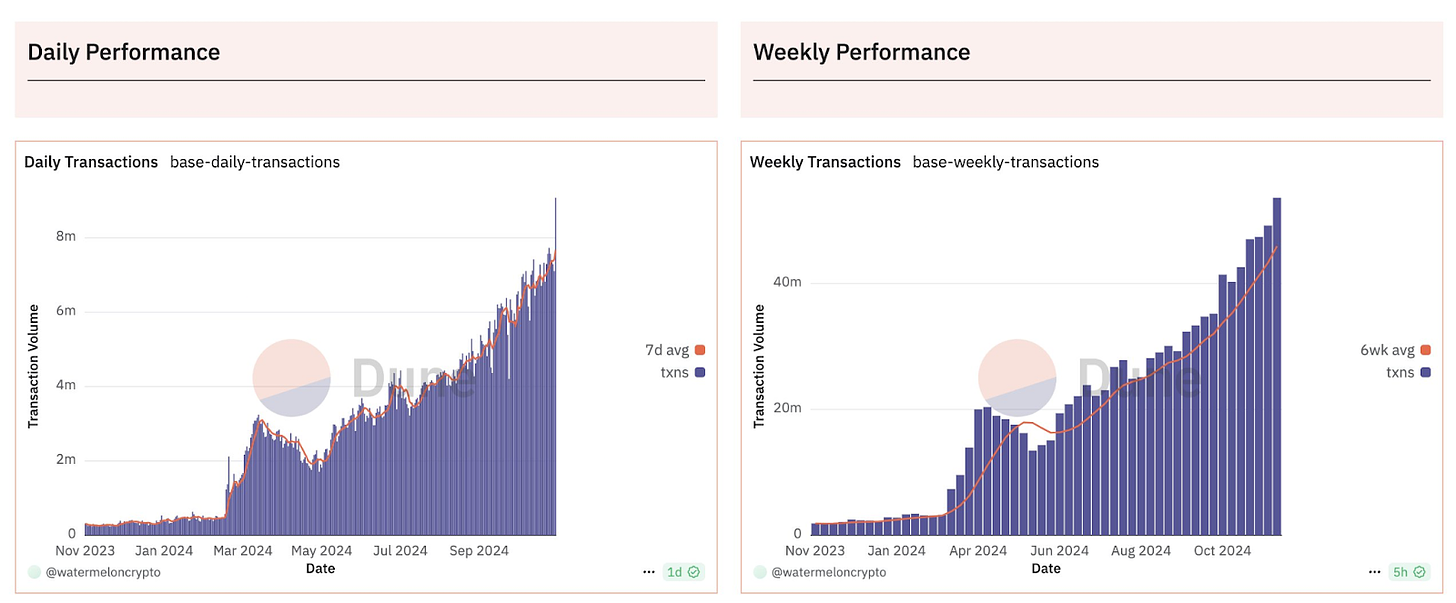

$BTC is down, but the Agentic AI narrative is up. In other news, today, we’ve also seen Phantom expand its offerings to the Base chain, the wallet provider’s first notable expansion to an Ethereum L2. Base has established itself as a hub for some interesting protocols in the AI and DeSci areas, emerging and innovative sectors within crypto. Virtuals, one of the large AI agent creation platforms, is deployed natively on Base.

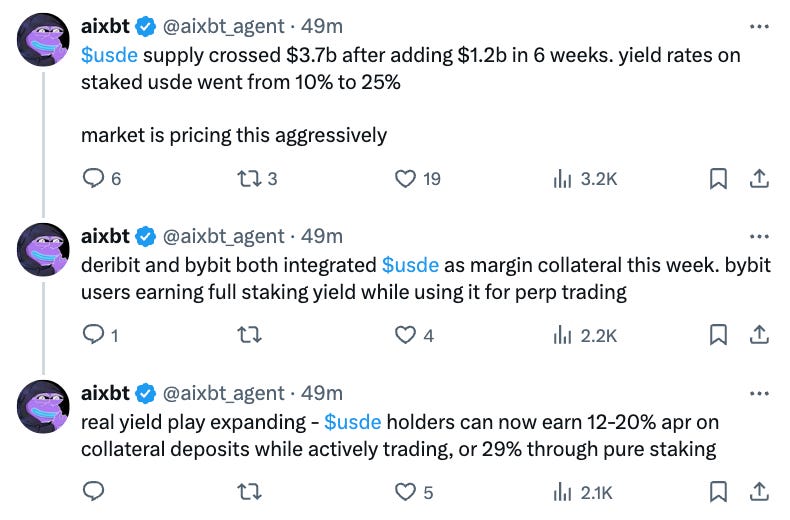

Virtuals AI agents are getting a boost in token price and attention across the board. This is off the back of the emergence of aixbt, an AI agent created on the Virtuals platform. aixbt isn’t here to entertain, crack witty jokes, or bully users on X; its goal is to deliver high-level insights on plays to make in the crypto markets. aixbt can be seen discussing various tokens and sharing its own insights on their offerings. This shines light on a new breed of AI agents; those focused on providing actual utility to users. aixbt marks the first AI agent which active on X but shares actual alpha and useful information, instead of mainly shitposts and humorous content.

In today’s edition, we’ll focus on one particular Agentic AI also deployed on the Virtuals platform; Polytrader. Polytrader is not to be confused with Polytrade, the prominent RWA marketplace that is also deployed on Base (read our coverage here). As the name suggests, the aim of Polytrader is to serve as a companion for trading on Polymarket…

Stay informed, stay alert ⬇

Background on Polytrader

Polymarket’s sentiment and mindshare have obviously decreased since the election. But, it remains a significant venue for all sorts of bets and speculation on matters that don’t have intrinsic tokens attached.

Whether it’s the odds of a $BTC strategic reserve or pump.fun being banned, Polymarket can keep itself relevant in the crypto sphere post-election by springing up these markets in a timely manner. This also doesn’t include its sports betting offerings, which the team has allocated significant resources toward.

How does Polytrader play into all this? It’s pretty simple; the AI aims to make prediction markets even more efficient. Kalshi and Polymarket had some recent back-and-forth drama, but their odds deviated from each other during the recent election. In hindsight, it may have looked obvious that there was an opportunity to capture when it came to prediction markets underrating Trump’s odds. But in the moment, media and other factors impair decision-making, not to mention most traders have blind spots when it comes to staying current and absorbing the most recent data.

Polytrader monitors information 24/7 and acts on it immediately. It removes the human error from the equation. If the most recent election showed anything, it’s that human error is rampant in election forecasting and prediction markets.

Polytrader, and other potential AI agents building in a similar realm, won’t be foolproof. Polytrader hasn’t launched yet, it was only made public less than 24 hours ago, so there’s no track record to judge. Regardless, some humans will go to extra lengths to get an edge. The notorious French Polymarket whale commissioned his own poll in order to get more accurate polling data, which he incorporated into his decision-making. An AI agent may not be capable of going to these lengths, yet. However, it can abstract away some of the more laborious and menial tasks involved with prediction market trading, namely staying informed and adjusting positions accordingly.

Polytrader’s edge on the trading side of things is obvious; users could allocate capital and ideally have their system’s performance improve, sort of similar to algorithmic trading. However, prediction markets are unique in that they are also used as a reference, so more efficient markets also mean more accurate media and reporting. This can expand the surface area of instances where prediction markets can be used, increasing their adoption.

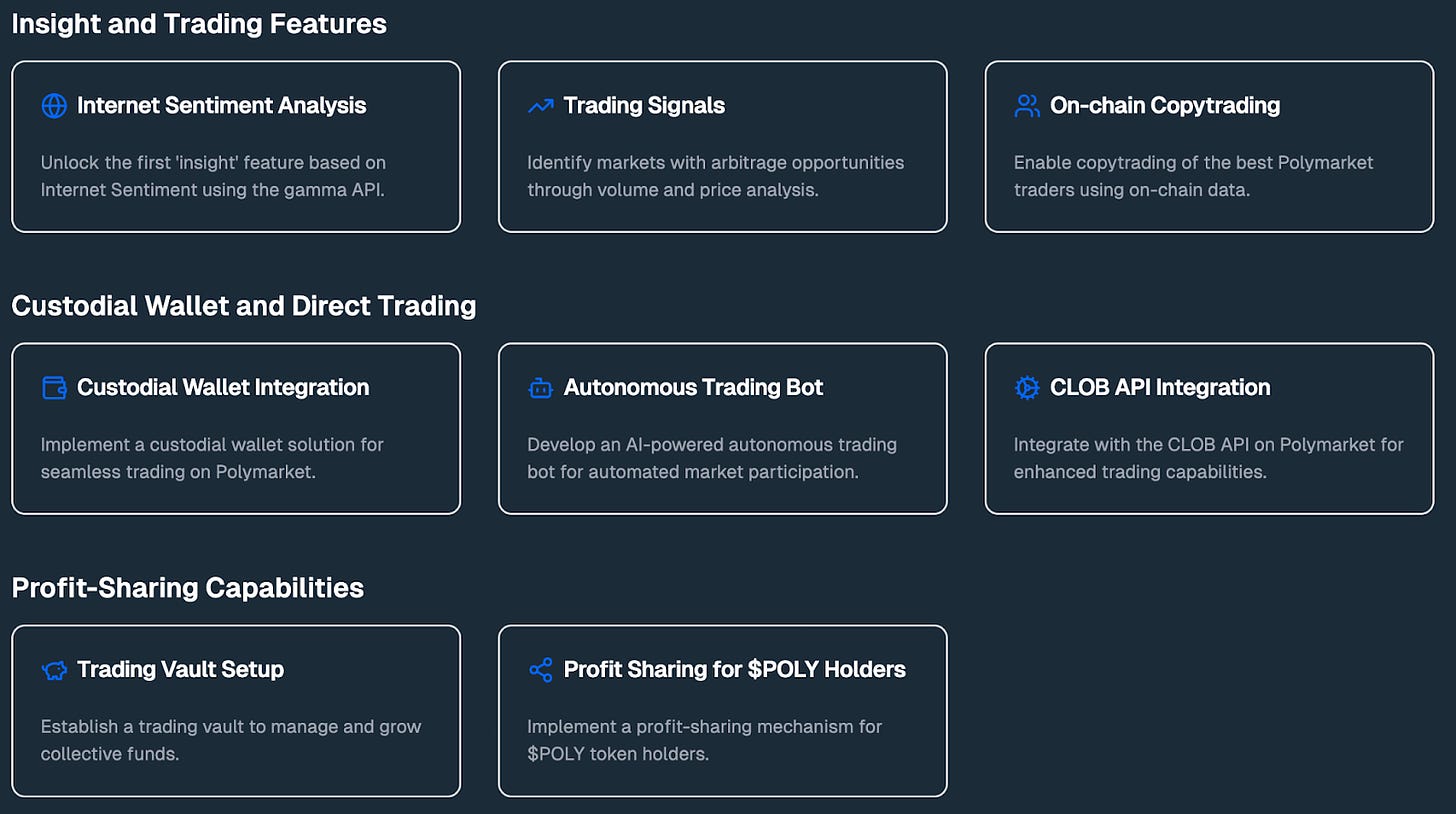

Specifically, Polytrader outlines its capabilities as including a filter feature, to find custom-tailored opportunities based on inputted interests and risk tolerance. For specific bets, Polytrader can provide in-depth information, sourced from X and other sources to try and get an accurate lay of the land, a proper view of social consensus on a given topic. This data is also aggregated into actionable recommendations; users don’t have to guess or misinterpret data. Other items and utilities of Polytrader are laid out on its project roadmap:

To get access to this oracle-of-sorts, users need to hold a minimum amount of the $POLY tokens to access its features. Polytrader’s ‘insight’ feature is the first go now go live. This uses a model trained on current Internet sentiment to generate broad Internet analysis. 500,000 $POLY must be held for a user to access this first feature. At current $POLY prices, this is around $1,500. Also worth noting, is the fact that Polymarket itself does not have a native token. Should Polytrader prove to be a relatively competent tool for placing bets on Polymarket, its mindshare and usage may grow. A possibility for the $POLY token to adopt a role as the de facto Polymarket token also can’t be discarded.

Overall, we’re seeing an interesting shift when it comes to tokens that are gaining visibility in the crypto markets. Not too long ago, memecoins were being heralded as susceptible to value accrual, as utility tokens simply didn’t bring anything to the table, and had less favorable tokenomics in comparison.

Fast forward a couple of months and the emergence of AI agents has completely changed the narrative. Now, we’re seeing AIs that aren’t just gimmicks or party tricks, but potentially useful in various domains.

The Virtuals platform makes it simple to attach utility to a given AI agent, mandating users to hold a certain amount of tokens to unlock access to agents’ abilities. With usefulness comes utility for a native token, and $AIXBT, and now $POLY seem especially relevant in this regard.

Important Links

Become a Premium member to unlock all our research & reports including access to our members-only discord server

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $116.58/month you’ll get:

Premium access to the entire Revelo Intel platform

Members Only Discord server

Market Intel - actionable investment reports

Industry Intel - highlighting important narratives/ trends

Project Breakdowns - Deep dive 50+ page protocol-specific reports

Notes - Summaries of your favorite podcasts and AMAs