SolCard - Web3 Debit Card for the Masses: What You Need to Know

Instant-issuance Card, 50K USD Monthly Limit, & More

While today’s newsletter title and subtext might read like a credit card email advertisement, it’s far from it. In today’s edition, we’ll talk about the debit and credit card space in crypto. It wasn’t too long ago (a couple of years) that we saw a mass exodus of sorts in the crypto debit card space, mostly dictated by Mastercard. This included the card payment giant canceling their partnership with Binance as well as putting an end to their BitPay debit card solution, which included the BitPay non-custodial wallet where users could easily send stablecoins to the card. This mainly affected americans, though there is definitely a drought in the space of easy-to-use crypto card payment solutions worldwide. Existing options now include the crypto.com card which works similarly but just as an exchange without the non-custodial wallet built into the app.

Why are we discussing debit cards? Well, while on the surface it may not sound as sexy as earning large APRs or airdrops by depositing volatile tokens onto an application, crypto payments are easily a form of low-hanging-fruit when it comes to real-world usecases, which the industry is in desperate need of. Consensus has shifted to a clear demand from users and investors alike for apps but the teams working on them are few and further between at least when compared to infrastructure ventures.

Onchain users may know how to make money in a myriad of ways, at least some of them, but actually spending it is a different matter. Countries like Australia, among others, have certain restrictions on how much crypto can be liquidated and withdrawn to bank accounts from exchanges. Besides this, there’s simply a convenience factor as well, some people don’t want to wait for deposits to get to their bank account, which in many countries, can actually take a bit of time. So as the crypto marketcap grows demand for means of spending this ‘money’ will also grow. Polymarket and various other dApps use 3rd party verification providers to accept credit and debit cards, though it’s not foolproof by any means and hiccups can often occur. The offboarding side of things seems like an area that has fewer solutions built out despite some lingering weariness of using exchanges post-FTX collapse. Now that we’ve set the scene, today we’ll be discussing the SolCard in particular, a specifically Solana-based card option.

Stay informed in the markets ⬇

Background on SolCard

SolCard has a pretty simple premise; users can deposit SOL (or stablecoins) onto the platform and then spend this as USD in real life or for online payments, accepted by over 150+ merchants including Shopify, Amazon, Apple, and many more. This can definitely by done with other options, using non-stablecoin crypto balances to fund debit card balance, effectively market selling these tokens when purchases are made. The card boasts no annual or monthly fees, a simple application process, and apparently a very accommodating refund process as well with the aims of being on par with fintechs like Wise and Revolut. So there isn’t anything crazy going on here, but the process of setting up a card business and partnering with popular merchants is no walk in the park and is definitely a moat of sorts.

There is also a financial privacy element as well. Many crypto users don’t like offramping and being subject to tax reporting that often comes obligatorily with exchanges. Overall the process to receive a new card is very fast and surprisingly doesn’t have any verification. Users will have to give their address to receive the card, this is about it. Non-KYC users can spend up to $10K per month, with ID verification required for $50K or above. Users can receive an issued digital card and begin making purchases likely in less than 5 minutes.

The card can be instantly issued upon sign-up, with $50K monthly top-up limits. The minimum top-up limit is 0.5 SOL, so at $100 this may be a little high compared to normal cards. Mastercard and Visa cards are issued. Users can also top up USDT and USDC with a 5% fee. A $6 fee is charged on the first deposit, the cost of actually issuing the card. Minimum top-up is $20, and the maximum is $5K, at a time.

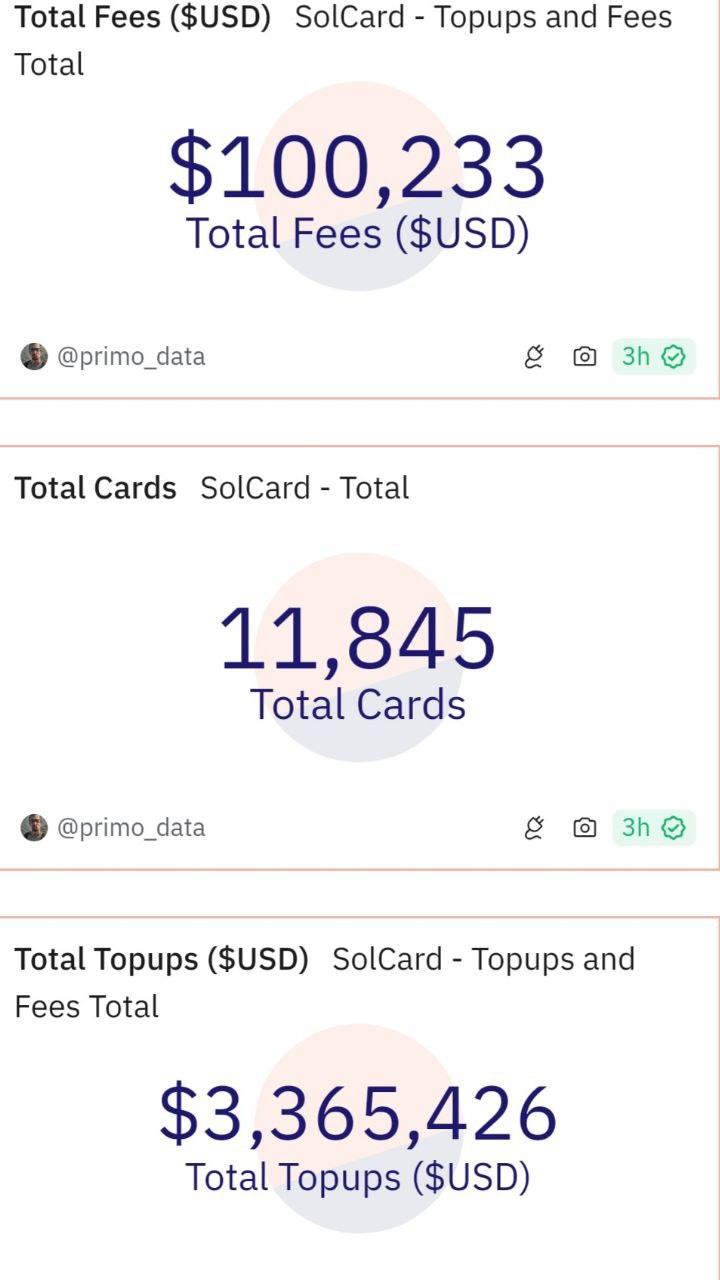

As you can see below, the app has quickly seen a lot of adoption, though it should be noted that each account can order up to 10 cards. There may not be much benefit to having numerous cards besides just having backups or if an individual consistently spends more than the $50K recharge limit that applies per card. Users would have to make another account to get past this limit.

How does this option stack up against competitors? The name that first comes to mind is Etherfi’s EtherCash, which has yet to launch. This includes the Cash mobile app, which brings some functionality that users forego even when depositing on exchanges or using existing options like crypto.com or Nexo.

“the launch of the Cash mobile app, connected to users’ Ether.Fi accounts can play a critical role in onboarding non-crypto native users, allowing them to borrow against high-yielding balances like $eETH or Liquid deposits. This app aims to bridge the gap between crypto and real-world financial activities,which increases the total addressable market (TAM) by several orders of magnitude, allowing users to spend in USD while they continue earning DeFi yields.”

- Revelo Intel, ether.fi Market Intel

SolCard has its own native token, SOLC. While not implemented, this token will also be used for debit card topups in the future. At the end of the day there’s going to be a lack of mechanisms for the token to be intertwined with the performance of the app, it basically serves as a stock with unproven voting rights. This is the case for many protocols like this and can be both a good and bad thing depending on what a prospective buyer wants. There is a cashback program for SOLC holder in the works, which will enable a tier-based cashback structure for stakers. This money could be denominated in either SOL or SOLC, in an attempt to build up SOLC as a sort of soft currency for card users like how SOL is used for Solana ecosystem users, NFT traders, etc. There is ongoing revenue share for SOLC token holders, specifically those that hold a certain threshold of 50,000 SOLC tokens.

Overall this is a pretty interesting idea and reflects a level of pragmatism that may otherwise be hard to find outside of Solana. One other example is the implementation of Solana Blinks, with just one use case being enabling users to purchase NFTs right through the twitter UI. Last week we also discussed DePlan, another Solana-based protocol operating in the IRL payments space with a very unique focus…

Become a Premium member to unlock all our research & reports including access to our members-only discord server

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $116.58/month you’ll get:

Premium access to the entire Revelo Intel platform

Members Only Discord server

Market Intel - actionable trade ideas

Industry Intel - important trend & narrative overviews

Project Breakdowns & Timelines - Deep dive 50+ page protocol-specific reports

Notes - Summaries of your favorite podcasts & AMAs