Stacks Ecosystem: StackingDAO & Hermetica - What You Need to Know

Origin Stories, Insights from the Team, & More

Happy election day: US politics are sure to be the foremost topic on everyone's mind for at least the next 24 hours or more. In the meantime, we’ll take the opportunity to discuss some more crypto-specific topics. The $BTC scaling and specifically the Stacks Bitcoin L2 ecosystem are particularly interesting areas right now.

For one, $BTC has outperformed the other majors on a multi-year time horizon; many even expect that this might continue after the election. While $SOL had a metric rise from the sub $8 levels, it has yet to punch in an ATH, and $ETH’s price speaks for itself. $BNB has actually been the major token to see limited volatility, tracking $BTC the best while producing fresh ATHs, albeit barely. Regardless of price, the debate around $BTC scaling has long often included onboarding some otherwise idle capital onto smart contract-supporting platforms like Stacks.

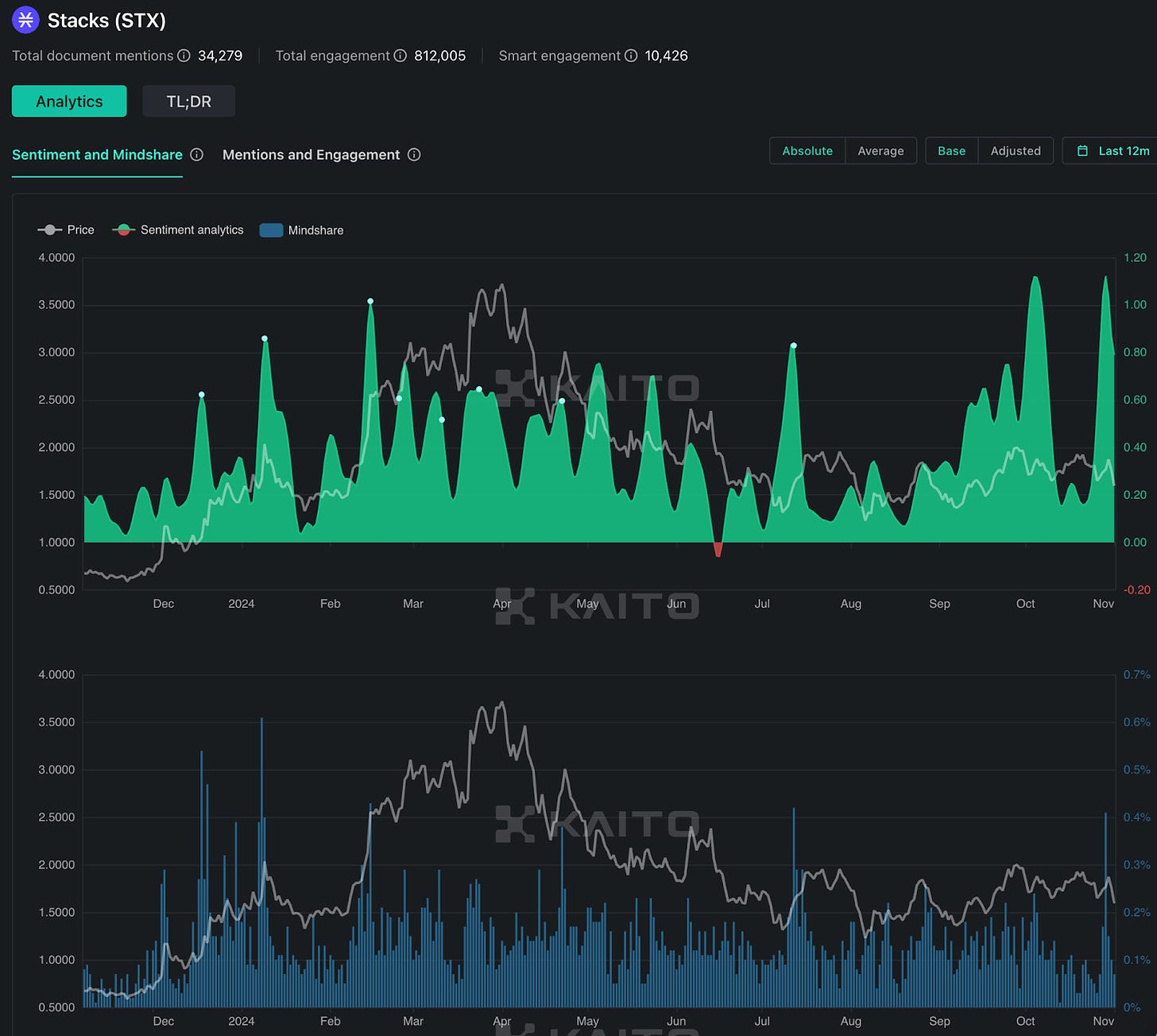

$STX price has yet to meaningfully recover from the highs found in Q1, 2024. Regardless, sentiment and mindshare have far eclipsed price recently, due to the Nakamoto upgrade which is now live. The primary implications of this are that Stacks transactions once confirmed are now at least as irreversible as Bitcoin's. A significant reduction in transaction times. The technical foundation for sBTC is also launching later this year, providing a wrapped $BTC alternative, in addition to increased activity from Stacks ecosystem builders.

In today’s edition, we’ll focus on the Stacks ecosystem, discussing StackingDAO, the leading LST provider on Stacks, as well as Hermetica, a protocol building a $BTC-backed synthetic dollar somewhat similar to Ethena.

Stay informed in the markets ⬇

Background on StackingDAO

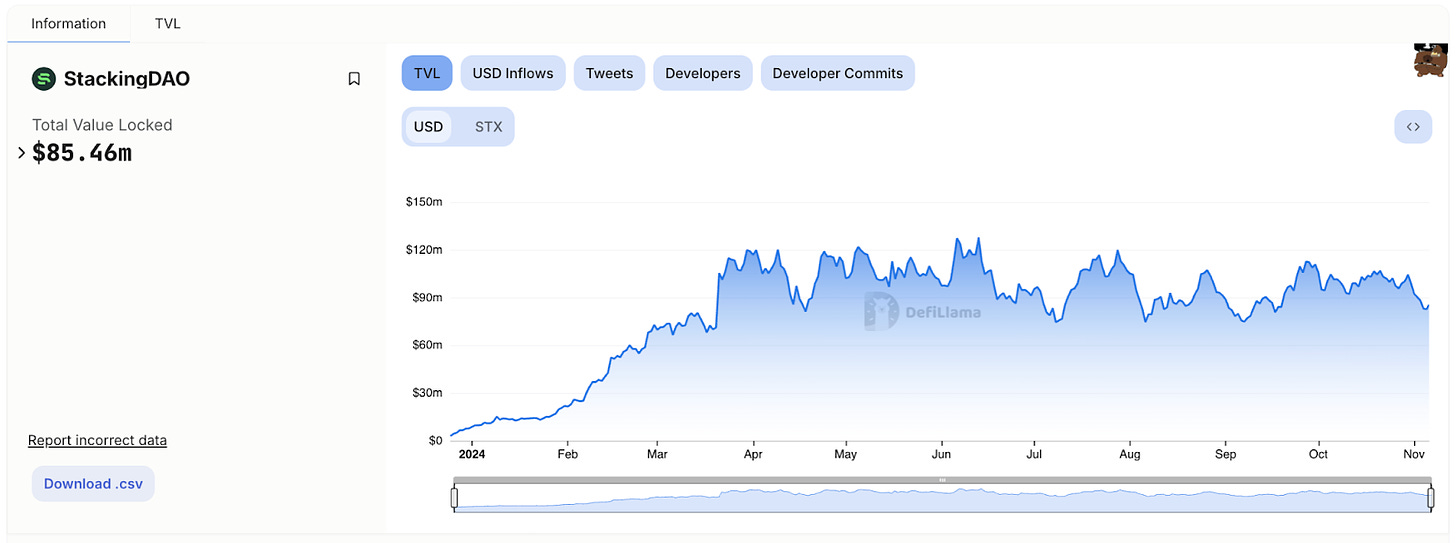

StackingDAO is the leading liquid staking protocol on Stacks. Users can use StackingDAO to earn stacking consensus rewards (9%+ APY) while retaining liquid $STX tokens. Similar to Lido, users deposit $STX for a liquid receipt token, $stSTX.

The premise of StackingDAO is relatively simple. But with strong execution, the protocol has become the largest on the Stacks L2 today. Ensuring that there are useful integrations for $stSTX on other protocols is also paramount for liquid staking protocols so that users can actually see some benefit from having their stake be liquid. $stSTX has uses cases on top DEXs like Bitflow and Velar, lending protocols like Zest, and CDP protocols like Arkadiko, and even Hermetica…

As new blocks are minted on the Stacks blockchain, $STX stakers can earn consensus rewards as well as transfer fees. Miners mining blocks contribute $BTC which is passed over to $STX stakers, in the proof of transfer mechanism present in Stacks design. StackingDAO actually auto-compounds these rewards back into STX, maintaining maximum exposure to the token.

StackingDAO also has a network of validators onboarded, including Blockdaemon, and Chorus One, among others. StackingDAO delegates deposited $STX to these operators, which handle node operations and infrastructure to generate rewards for users.

Background on Hermetica

Hermetica is building a $BTC-backed yield-bearing stablecoin ($USDH) on Stacks and Runes. Liquid staking, as provided by StackingDAO, is an essential component on popular blockchains today. The Hermetica team operates under the presumption that a reliable stablecoin is also an essential piece of a proper ecosystem, which is consistent with the role that stables play on all other major blockchains.

Hermetica goes a step further though, backing this stablecoin with $BTC specifically, to create a Bitcoin-native stablecoin. The Hermetica team strongly believes in the ethos of building a stablecoin that is independent of the existing fiat currency system, with the option to forego using US treasuries as backing being a key point of focus.

Under the hood, the $BTC backing of USDH is also paired with a short $BTC perps contract, hedging the Bitcoin position with the goal of locking in the dollar value which is represented onchain as the stablecoin, $USDH. This way if the $BTC value falls, the backing can remain intact, from the short position growing in value. In this sense, Hermetica is sort of going in the same direction as Ethena, but for $BTC, and with the perpetuals only going one way; short. This creates a dynamic where sUSDH is more attractive during bull markets.

Also like Ethena, users can earn a yield with their $USDH, by staking it on the Hermetica platform. This creates a liquid staking token, $stUSDH. This LST is required to accrue the value from the funding rates, which will disproportionately accrue during bullish time periods where it pays more to be short. Right now this comes out to ~12% APR, going as high as 25% or even 30% depending on the market environment. In bearish periods, the short position will be more in profit, ideally offsetting the decrease in value of $BTC price at the time of USDH issuance.

Behind the scenes, the operation of Hermetica is somewhat simple; $BTC is held, and used as collateral for margin on top-tier CEXs including Bybit and Bitget, to short $BTC. While some might voice concerns about the use of CEXs, the actual coins are not held on the exchange in accordance to the exchange’s margin systems, ensuring that they can’t be affected in case of bankruptcy. The vast majority of open interest is also found on CEXs (~95%-97%), which are dominant in marketshare compared to DEXs.

If you found this newsletter useful, you might be surprised to learn that all of the content in today’s edition is from our Revelo Roundtable episode last week.

We had on both Leeor and Jakob from StackingDAO and Hermetica, respectively. If you found this insightful, listen in weekly to hear more from top-tier founders and builders from across the industry.

Important Links

Become a Premium member to unlock all our research & reports including access to our members-only discord server

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $116.58/month you’ll get:

Premium access to the entire Revelo Intel platform

Members Only Discord server

Market Intel - actionable trade ideas

Industry Intel - important trend & narrative overviews

Project Breakdowns - Deep dive 50+ page protocol-specific reports