Synonym Finance - Crosschain Native Credit Layer: What You Need to Know

$SYNO Incentives, Wormhole Crosschain Framework, & More

In yesterday's edition, we covered Aurelius Finance, a lending market, and CDP all in one protocol. Today, we’re keeping the DeFi and money market theme going, with Synonym Finance. For those unfamiliar, you can get an intro into what Synonym is all about by listening to our latest DeFi Revelations episode with the team, released last week.

Synonym Finance is a crosschain-native credit layer. Users can access money markets across multiple chains, unburdened by the fragmentation present in the EVM ecosystem. By now, being multichain is the norm among lending protocols, and most DeFi protocols are large. Being crosschain native, and providing a single interface to interact with liquidity across chains. Users can lend on one chain and borrow on another, reducing reliance on bridges.

By now, one might think the problem of bridging should largely be solved, but new chains continue to crop up, delaying this ideal scenario. A game of whack-a-mole has ensued between bridging providers and projects expanding to new chains using incentives to attract users. Lack of adequate bridging is one of the primary reasons users today may opt to forego chasing incentivized in some cases, while other basic onchain primitives are pretty much commonplace and available across any chain.

One group that Synonym could maybe hope to see some adoption from is institutions. Institutions tend to be very hesitant to engage with money markets in DeFi, especially the more unproven ones, as this risk may be hard to explain to LPs. As a result, this capital is skeptical of undertaking smart contract risk as is; but increased ease of managing crosschain positions as introduced via Synonym could be one step to make some institutions think twice. This simple convenience aside, Synonym Finance also has some enticing incentives underway right now…

Background on Synonym Finance

Synonym describes itself as a crosschain native credit layer. Synonym is building in the crosschain native lending space; by offering native crosschain options for lending and borrowing, the need for users to migrate their assets to less preferred chains in the first place is mitigated. Users can access loans denominated in more assets on their favorite chains right from the point of loan origination. This can significantly shorten the amount of clicks and transactions users have to make to execute multi-leg lend/borrow strategies. This only compounds as the protocol continues to add more chains and assets, enabling more possibilities where users don’t have to use external DEXs and bridges to facilitate their money market interactions.

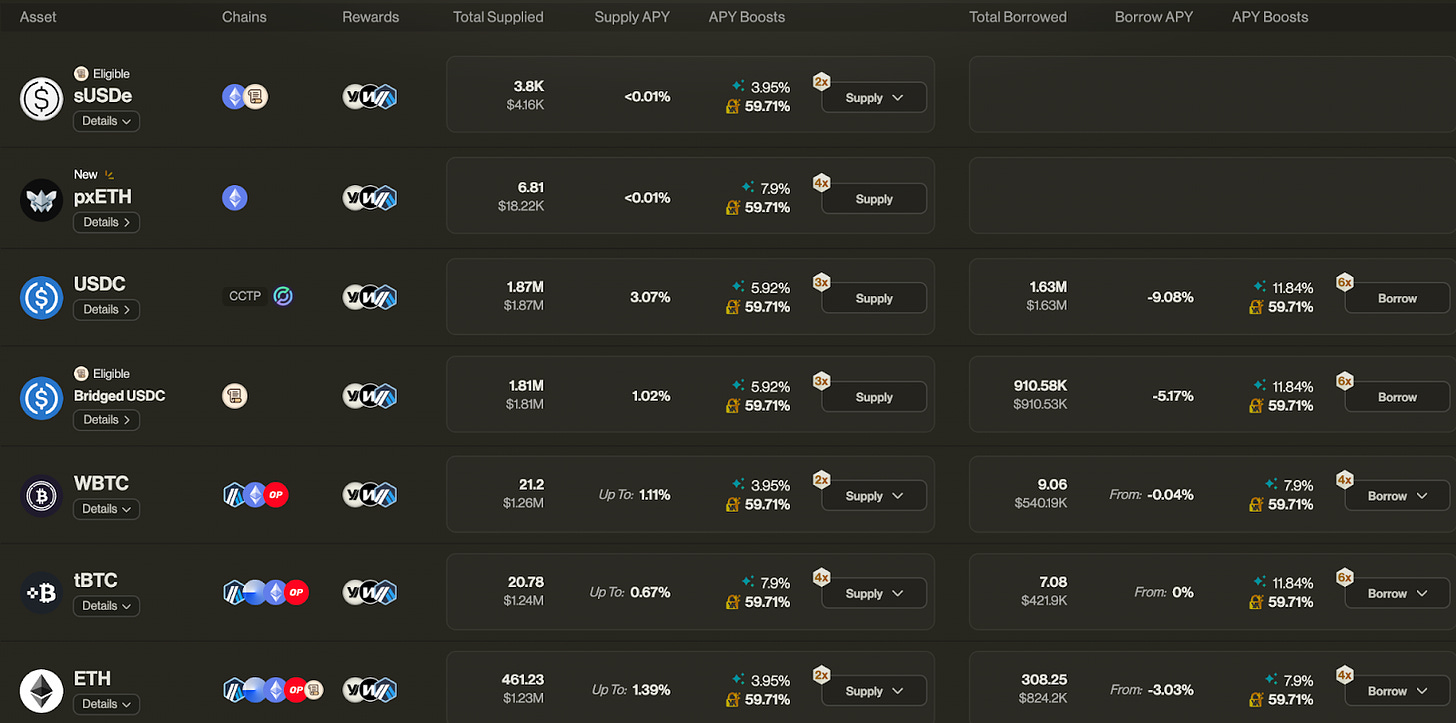

The driving factors for demand for what Synonym offers are clear, as most onchain users have experienced the pain points around bridging and wrapping assets. As you can see below, a variety of assets are available to lend and borrow across various chains. Recently, GMX single token pools have been added, in gmBTC and gmETH.

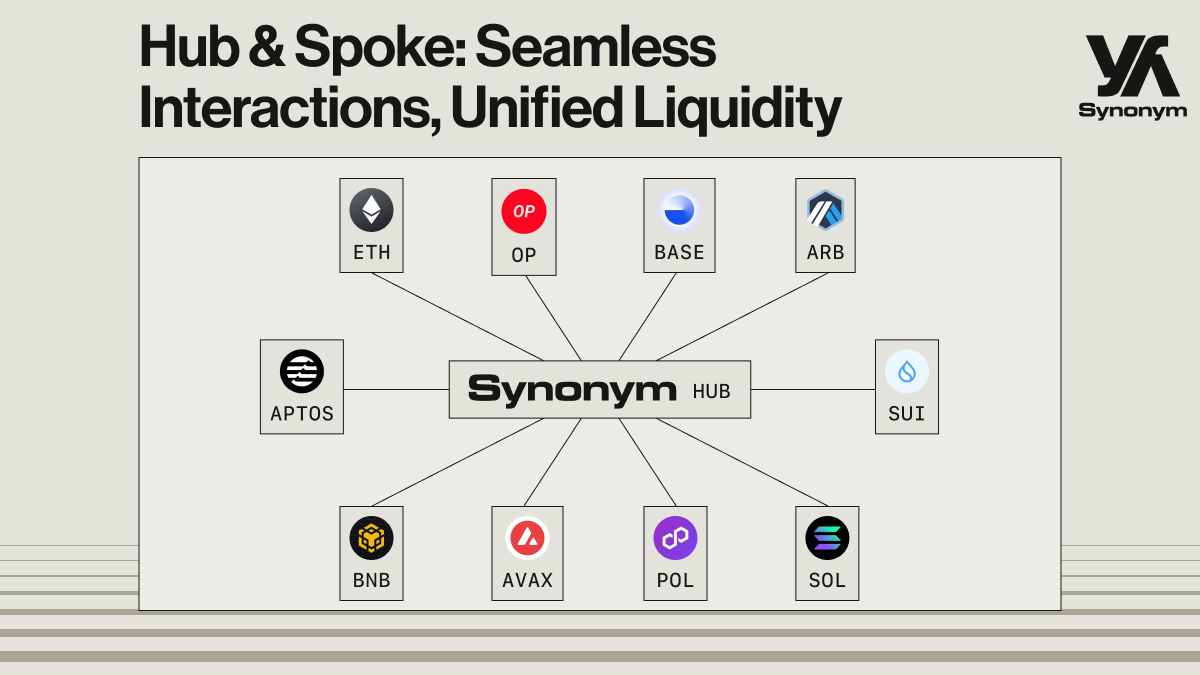

OK, so how is this all possible? The protocol is built on Wormhole’s xChain stack, to support multichain functionality easily. This is not without its drawbacks, as having a core part of a protocol’s bread and butter significantly dependent on a third provider always brings centralization concerns. To help combat this risk vector, the team employs the Hub and Spoke architecture. This basically designates a ‘Hub’, a centralized accounting and liquidity layer, in this case, Synonym, while the other integrated chains act as spokes. Synonym acts as the authoritative source of information in this system, giving the protocol more control when it needs it.

The team opted to use the Hub & Spoke model; as opposed to the point-to-point model. Avoiding interest rate desync, which can be more prevalent with the point-to-point mode, was one key consideration to not going this route, as this becomes more of a concern as the number of assets with different interest rates floating around increases. The Hub and Spoke model helps to track all token pairings, mainly at the expense of speed though the team plans to address this in an update soon, keeping a close eye on this important aspect of the protocol.

The Hub and Spoke model that the team employs also allows for an update to be pushed under circumstances deemed a crisis or its equivalent, to quickly switch to a different crosschain messaging provider, like LayerZero. The team is also being proactive in building out an insurance fund to help reimburse users should the worst come to worst. Having backups in place when it comes to crosschain messaging and oracles providers, is seen as a priority.

Currently, Synonym is planning its expansion to Solana and explicitly leaves the door open for community feedback on what assets to list as collateral in the meantime. Because of its crosschain native framework, the team can be more receptive to specific requests. Wormhole in particular has proven to be the interoperability layer of choice for many a protocol looking to host both EVM and Solana assets.

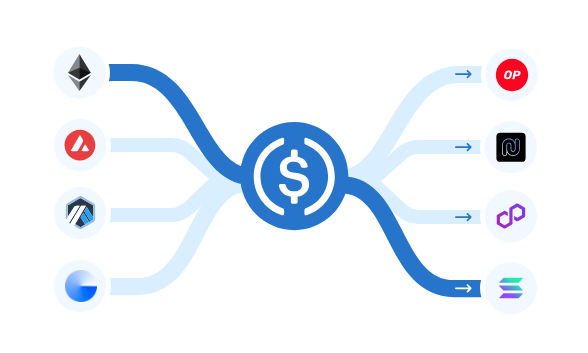

One specific aspect of Wormhole leveraged by the Synonym team is Circle CCTP. This introduces a natively interoperable USDC, a solution to the long-time problem of dealing with USDC.e, which likely leads to countless lost CEX deposits and confusion all around. This form of USDC can now instead be minted and burned upon a bridging request being sent from a chain and then received on another. Solutions like this are appreciated by users, but it is not the norm, providing a large gap for Synonym to fill and help bring value to the table.

Not to mention; the SYNO token is also already live, so the team is not holding the carrot of a potential but unconfirmed TGE over users’ heads. The protocol’s ‘SYNO Summer’ initiative is currently ongoing, until the end of August. Important to note, is that this initiative also rewards users in W, ARB, Ethena Sats, and Scroll Marks. In total, there are over 100K W and ARB tokens up for grabs each, as well as nearly 2M SYNO tokens to be distributed.

The SYNO token was launched not too far after the protocol itself, just back in February as Synonym is a very young protocol. TVL fell quite a bit during the Q2 dump but has already recouped back most of the ground lost, currently sitting at $4.8M, with another $4.5M in borrows, putting the total market size at $9.3M.

Important Links

Become a Premium member to unlock all our research & reports including access to our members-only discord server

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $116.58/month you’ll get:

Premium access to the entire Revelo Intel platform

Members Only Discord server

Market Intel - actionable trade ideas

Industry Intel - important trend & narrative overviews

Project Breakdowns & Timelines - Deep dive 50+ page protocol-specific reports

Notes - Summaries of your favorite podcasts & AMAs