*** IMPORTANT ANNOUNCEMENT ***

We have almost reached the cap for our Revelo Intel Phoenix lifetime memberships. These memberships come with a limited edition NFT which give the holders access to ALL our products FOREVER, including products we haven't released. The value you get is just insane.

Demand for these memberships has exceeded our expectations. We only have 9 spots left. Once they are sold we will never sell these lifetime packages again.

We will stop selling them at midnight EST Jan 31st 2024 or until the last 9 spots are filled.

The price for all our memberships will increase in Feb 2024 and we have several new research products rolling out shortly.

If you are serious about gaining an edge in the market, you need access to the work our analysts do every day and the private members only discord server. There is no better value in all of crypto than holding a Revelo Intel Phoenix lifetime membership.

Now lets get to today’s edition on Celestia…

Money talks in crypto; this has been evident with Celestia ($TIA)’s price action, rising over 10x since the modular token was airdropped to Cosmos ecosystem stakers on October 31. Few have a complete understanding of what Celestia brings to the table tech-wise, but many more understand some of the incentives around the coin.

In this edition, we’ll go over the current options, benefits, and drawbacks associated with $TIA staking, and airdrop farming as a whole.

Stay alert in the markets ⬇

RWAs are a popular narrative heading into this halving cycle. Onchain commodities are a missing piece in the current puzzle of DeFi offerings. LandX aims to fill this gap in the market by providing some of the most in-demand agricultural commodities to onchain investors. In our latest podcast, our Founder, Nick Drakon, sits down with LandX CEO LandWalker to discuss how the protocol brings the crop yield generated from real farmland onchain, and all the intracies and nuances in between.

Background on Celestia

Celestia brands itself as the 1st modular blockchain network that securely scales with the number of users. It basically allows anyone to launch their own blockchains and rollups without having to pay high data fees. At its core, Celestia is not natively a blockchain and can’t host smart contracts on its own; this is similar to the Cosmos Hub.

Celestia is based on the idea that layer-1 blockchains should not be responsible for computation and execution. The thesis is that consensus and Data Availability (DA) can be separated, allowing for more efficient execution of chains in rollups. Celestia’s business model lies in demand for outsourcing DA increasing.

The chart below depicts some ~$75 in daily revenue for Celestia. It is clear that valuations in crypto chase growth, but Celestia’s price action has another side to the story; airdrops.

Celestia Airdrops

A big part of the Celestia narrative isn’t necessarily its tech, but its potential for airdrops. As a DA layer, many projects and chains may find the protocol’s offerings attractive. It abstracts a piece of the puzzle away for developers, providing a building block in constructing new chains. Projects and chains using Celestia need a way to release their token, assuming they have one, and airdropping an allocation to $TIA stakers is thought to be a good way to distribute.

Airdrops like Dymension’s $DYM and AltLayer’s ALT have already allocated significant portions to $TIA stakers. This is in addition to $TIA’s staking APR which sits at around 15%, multiples higher than $ETH’s ~3.5%

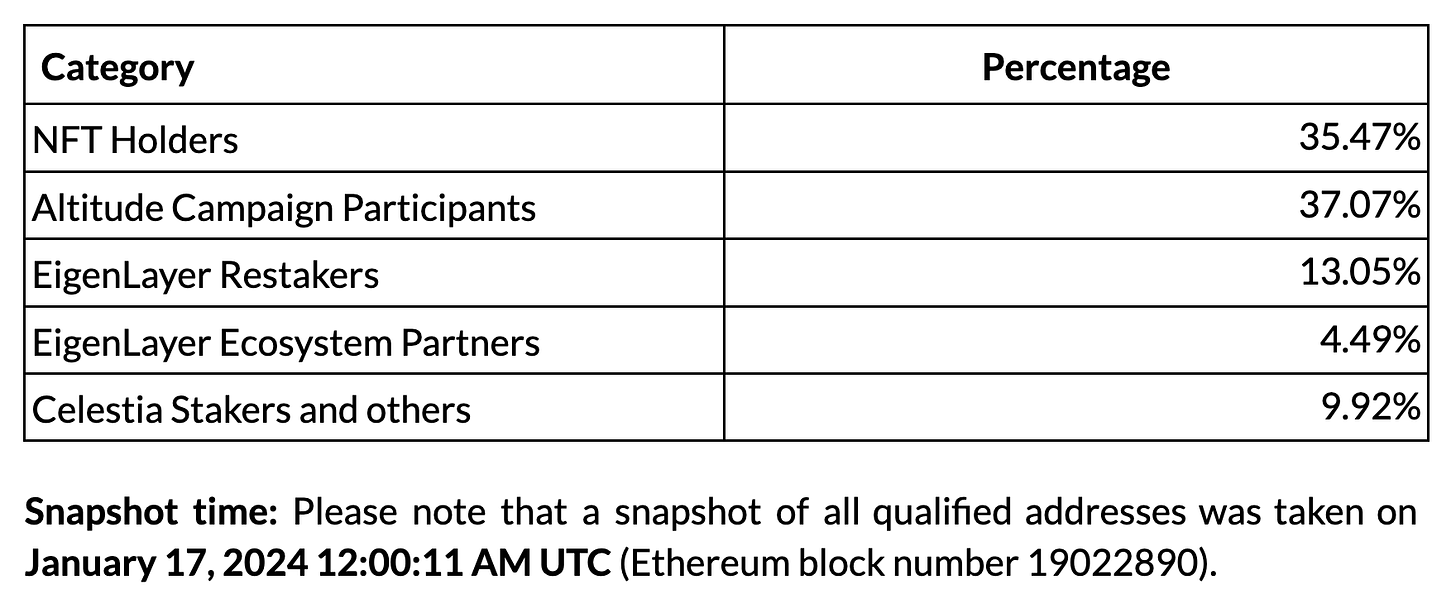

AltLayer’s allocation for $TIA stakers; claiming is live with details TBA for $TIA stakers

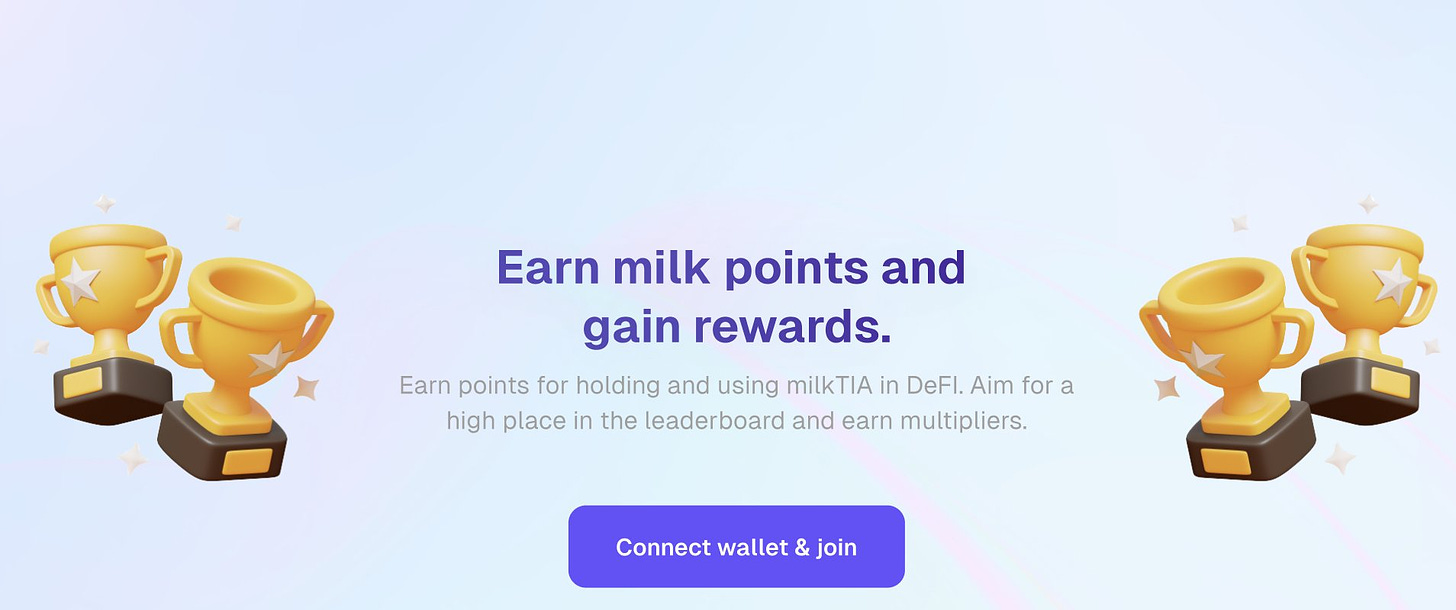

One alternative to staking $TIA which is gaining traction is to instead stake TIA on milkway.zone. MilkyWay is a LST protocol for $TIA, with TVL closing in on $40M. Users can stake their $TIA for milkTIA.

But the potential for points doesn’t end here; milkTIA can then be deposited on Demex providing yet another points layer on top of the initial $TIA. Demex is a Cosmos-based DEX that includes borrowing-and-lending, as well as perps trading. Users can borrow the protocol’s native stablecoin, or more common options like $USDT, and trade perps. The project has even introduced incentives for trading$TIA.

This opens up a can of worms for earning points with $TIA. Unlike simply natively staking $TIA, there is at least some sort of guaranteed benefit to going the liquid staking route. Whether this method earns more than natively staking $TIA remains to be seen, but it is more transparent.

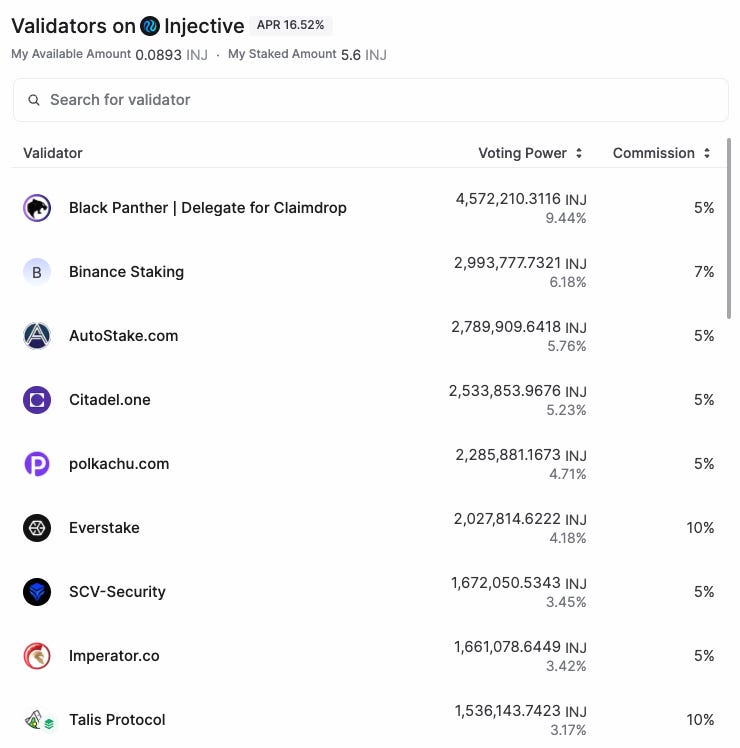

Injective is another with potentially promising airdrops for stakers. Injective differs in that stakers can receive some ‘guaranteed’ airdrops. Black Panther, an onchain asset management protocol, and Talis, an NFT exchange, have stated that all stakers who delegate to their protocol’s validators will be airdropped $BLACK and $TALIS, respectively. As a result, Black Panther and Talis hold the #1 and #9 spots among $INJ validators.

Keplr Staking Dashboard

Between Celestia and Injective, both of these protocols have real use cases in addition to people looking to potentially earn airdrops on their capital, and it can be hard to gauge what amount of price appreciation can be attributed to airdrop farmers. Nonetheless, the impact of incentives is very clear.

Access our free research here, from Analyst Insights to Project Breakdowns & more.

Points Programs: Current Climate

Points programs originated with Friendtech and Blur. They soon spread to projects like JitoSOL and Marginfi on Solana, and have now become commonplace across chains.

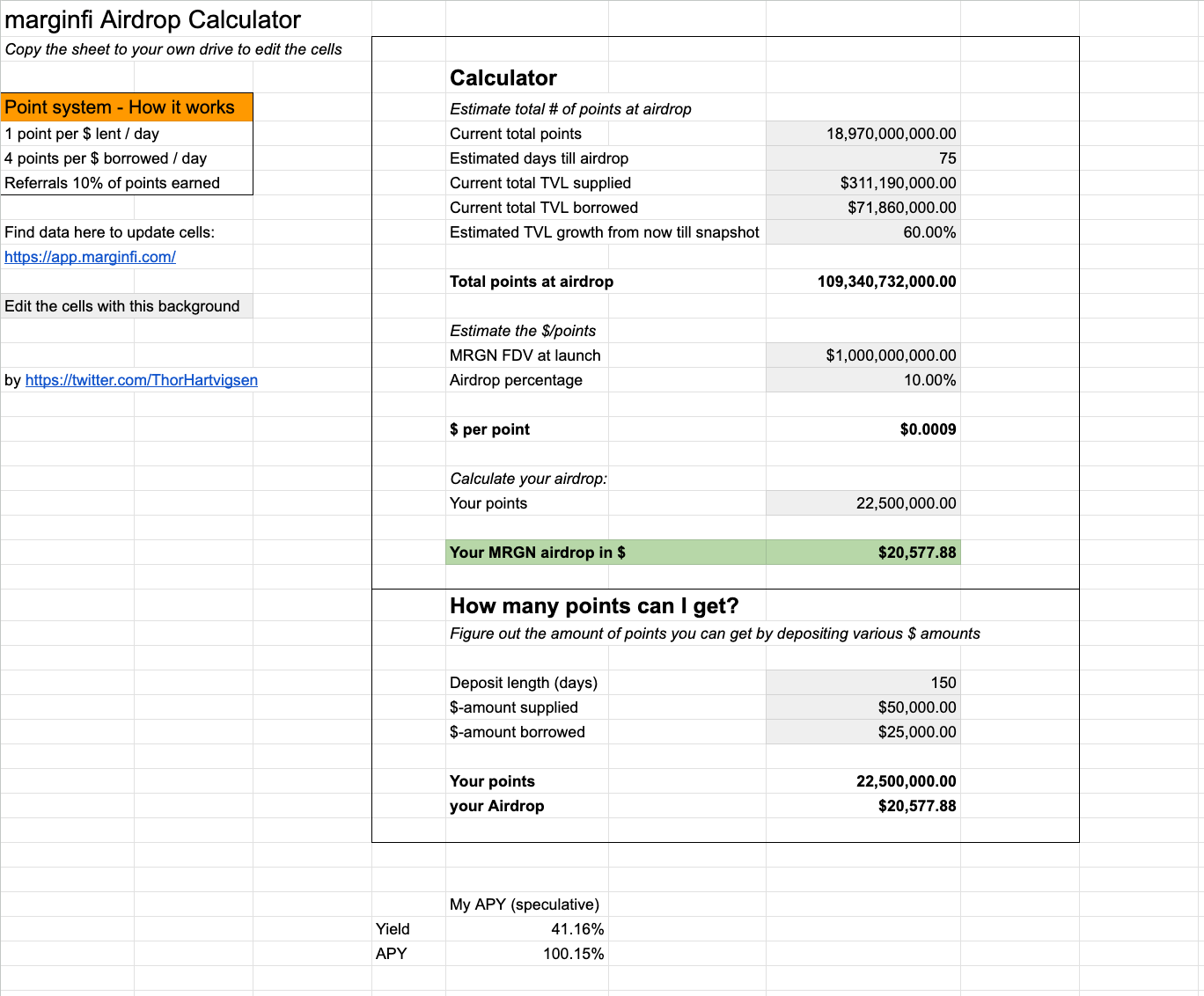

The main drawback of points is that they are soulbound tokens which cannot be transferred, and are at the mercy of the protocol. Marginfi, a prominent Solana lending protocol, has been criticized for not yet converting its long-running points program into a TGE. Some people try to work around this inherent limitation by coming up with valuation models of the given protocol and deducing dollar amounts per point. Ultimately, this is all speculation; these programs are subject to change at any given time. Tensor, the leading NFT exchange on Solana, reduced the points possible to earn from a specific NFT collection by 75%, as it was seen as a way to game the points system.

It is also unknown if protocols have an internal ranking mechanism, perhaps points holders will be split into tiers with larger holders receiving top-heavy rewards, or maybe all points will be valued the same. Tier systems might take into account # place on the leaderboard.

Marginfi Points Calculator by Thor Hartvigesen: access here

There are now potentially multiple points programs for given activities, whether it be trading perps, or lending on a certain chain. From here, users will have to choose which program they prefer. Maybe they prefer the points program with more explicit messaging around an airdrop or TGE, or perhaps more points that can be earned for specific actions like depositing a certain asset.

Points programs are clearly the most beneficial for people. Points have now become so commonplace that avid users of multiple chains may have accumulated significant amounts of points and are now aware of it. This is different from some airdrops in the past, for example Uniswap’s $UNI, which was simply sent to eligible users wallets. With more on chain users than in previous months, protocols may need a way to filter users. Simply adding a claim page is an easy way to reward users who are most in tune to what’s going on on chain.

Dymension recently announced that 528,523 addresses claimed their airdrop rewards.; this means around 50% of eligible wallets simply didn’t claim. It may be more likely that users eligible for large allocations would be generally more active and more likely to claim, and that unclaimed addresses are comprised of users with less capital at stake and less on chain activity. With the minimum allocation per wallet being ~33 tokens, and $DYM trading at ~$3.2 on Aevo pre-market…this would result in at least ~$50M+ in value allocated to users who may be more likely to participate in governance, stake, or otherwise become interested in the ecosystem.