MetaDAO - Governance Proposal Prediction Markets: What You Need to Know

$META TGE, Futarchy, & More

We’ve talked a lot recently about the shift in focus toward user applications as opposed to infrastructure, even highlighting some interesting apps operating in payments and unused subscription markets space. Many have pointed out recently that Solana has surpassed Ethereum in 30-day DEX volume when traditionally Solana would only be expected to lead in DAU metrics. This sentiment is also reflected when it comes to innovative apps, with the majority of these also choosing to use Solana, even if the underlying chain doesn’t have a massive impact on the protocol itself. This is the case when it comes to DePIN, as these projects' success depends on other external factors more tied to product adoption than activity on a given chain. Solana is clearly the chain that prioritizes new ideas and new crypto market entrants, while the EVM reigns dominant when it comes to incremental improvements in performance and building use cases for savvy onchain users. As a byproduct, many will likely agree that Solana is pretty permissive of ideas outside of the norm with a user-centric focus.

In today’s edition, we’ll be discussing an interesting protocol on Solana belonging to a category many may gloss over; DAOs. Once upon a time, DAOs were all the rage, with DAO tooling being one of the sectors with the most VC backing in all of crypto. Projects like Upstream and SuperDAO, despite raising significant funds in the eight-figure range, have struggled to show much progress. This year, SuperDAO ended its operations and returned the remaining funds to its investors.

Everyone knows that incentives dictate outcomes. PolyMarket has been one interesting example in which users are incentivized to cast biases aside as much as possible or risk losing money, and these incentives have seen the market prices react extremely fast upon news dropping. The case of PolyMarket has also clearly highlighted a lack of value flowing to infrastructure, as MATIC’s price has vastly underperformed the rest of the market despite the chain hosting what many would regard as the most popular app of the past few weeks. The app has put into perspective that talk is cheap, and using markets to speculate on outcomes might be a better way to get a point across than bickering on the timeline. Today we’ll be discussing MetaDAO, a protocol looking to implement something called ‘futarchy’ to the blockchain. Futarchy is a concept of prescribing the implementation of prediction markets in government, used to dictate national policy based on perceived outcomes and the value which can potentially be brought.

Stay informed in the markets ⬇

Background on MetaDAO

It doesn’t take a salesman to illustrate the fact that DAOs have long struggled with their operations. Some have been criticized for being too centralized, but more often than not DAOs can be categorized as decentralized but dysfunctional, or too decentralized. The reality is that sometimes a strong hand is needed to get things done, While many indeed prefer to live under governments that give them a go at choosing what to do, this line of thought doesn’t hold the same weight when it comes to private businesses or crypto projects when there is much less at stake. SOL outperforming ETH amidst the ETF trading commencing this week can perhaps be used to point out that people increasingly want a product that works, and decentralization is something nice to have if a baseline of efficiency has been established.

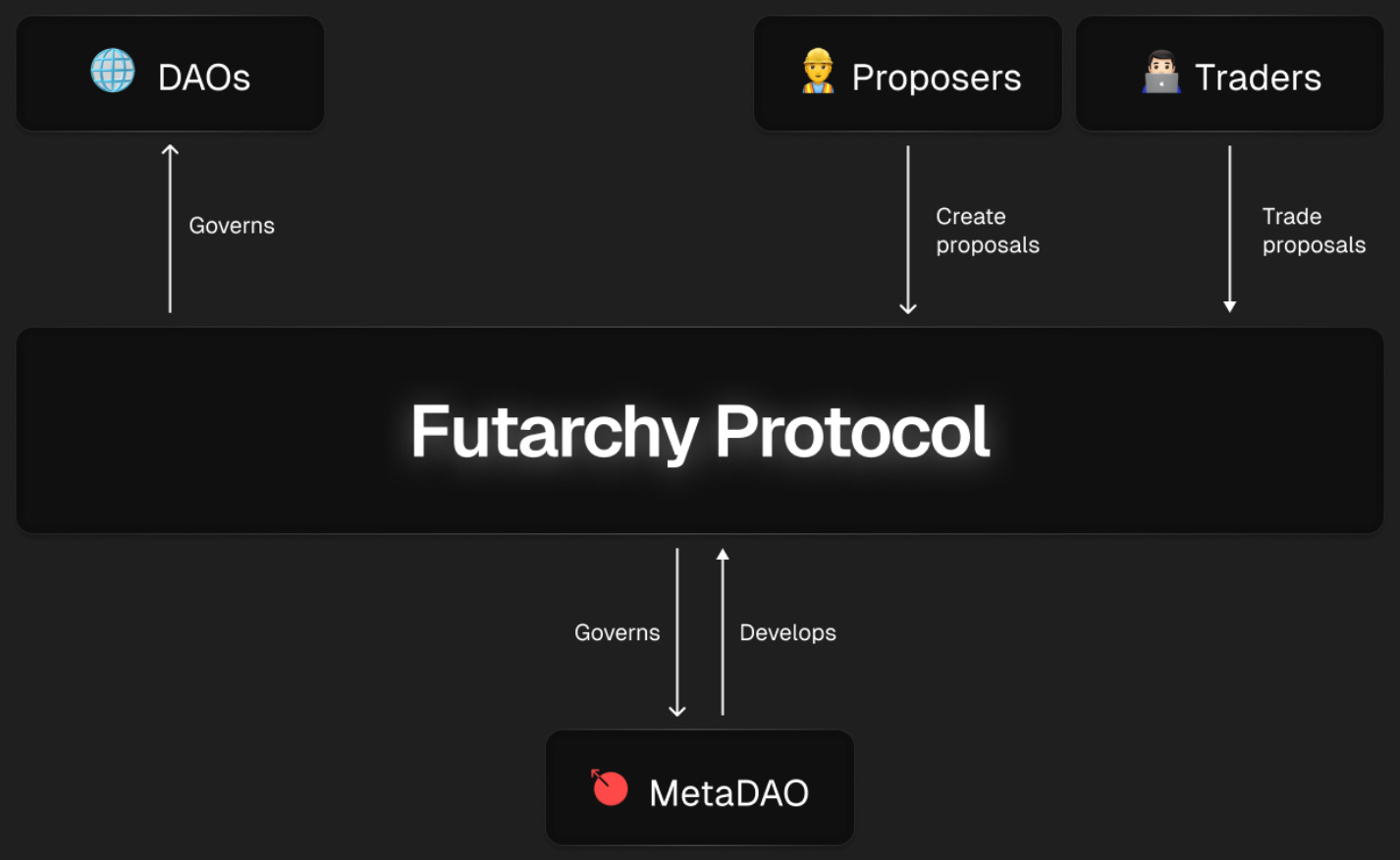

MetaDAO tries to decentralize the governance process but retain effective decision-making by making profitability the only factor to gauge the success of a proposal. The protocol describes itself as the world’s first ‘market-governed organization’.

In a nutshell, MetaDAO allows users to effectively trade governance proposals of other partnered projects. This is done through MetaDAO’s subsidized protocol, futarchy. The current iteration of MetaDAO sprung up as DAOs naturally needed to outsource some of their infrastructure and decision-making processes. Some saw what MetaDAO was doing and wanted this sort of model to be implemented for their own governance.

An AMM is created to provide a conditional marketplace. Conditional tokens are created, which allow speculators to trade options, essentially offering to purchase X amount of tokens if a certain condition is met. In this case, the only condition is whether a proposal passes or fails, so speculators are putting forth offers to purchase native governance tokens based on this outcome, aligning with their views on whether the proposal should pass or fail. This is then used to gauge sentiment and ultimately make decisions by using this process to determine whether to move forward with a given proposal instead of relying on votes. Decision-making in this regard is tied to the native token price, so while a proposal may be economically beneficial for a protocol in the long run, if the value accrual to the token is unclear or otherwise obfuscated, this will likely be overlooked in the futarchy market.

On one hand, this model definitely oversimplifies good or bad sentiment, as token price is not the only measure of success. On the other hand, it’s pretty hard to design a system taking all of these complex factors into account and letting speculators bet on them to develop an outcome. dYdX’s sale and the differentiation between equity and token price has also recently highlighted why token price indeed may be the best condition to account for when making decisions and creating markets. dYdX was able to bring in hundreds of millions of dollars in revenue which is definitely economically beneficial to the company, but this never materialized in the token price as it wasn’t distributed to holders. So making decisions based on a long-term value basis is also definitely flawed.

Futarchy currently enables the trading of proposals for Drift Protocol (perps DEX), Dean’s List (Network State protocol), Future Protocol (SPL token migrator for rugged projects), and MetaDAO itself. In its current state, MetaDAO may be somewhat primitive and contained to the Solana ecosystem but the concept it represents and its use of blockchain to accentuate its premise is interesting to watch. According to the project’s founder, MetaDAO has processed some $3.1M+ in volume, across ~4,700 trades made by ~345 traders.

The META token launched in late February, holding a marketcap of ~$9.5M. The team took a very interesting approach when it came to airdropping this token. Naturally, a project like MetaDAO is a do-or-die type of thing. MetaDAO represents a novel concept unexplored, the first real-world implementation of futarchy, an economic concept coined 25 years ago. As such, META was airdropped to just 60 wallets, each receiving 10,000 tokens. Currently, the circulating supply is ~15,500 tokens, with an additional ~5,00 held by the DAO itself.

Important Links

Become a Premium member to unlock all our research & reports including access to our members-only discord server

Join thousands of sharp crypto investors & traders by becoming a Premium Member & gain an edge in the markets. For just $116.58/month you’ll get:

Premium access to the entire Revelo Intel platform

Members Only Discord server

Market Intel - actionable trade ideas

Industry Intel - important trend & narrative overviews

Project Breakdowns & Timelines - Deep dive 50+ page protocol-specific reports

Notes - Summaries of your favorite podcasts & AMAs